UK Food & Grocery Sector Report summary

November 2023

Period covered: Period covered: 01 - 28 October 2023

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Food & Grocery Sales

Food & Grocery sales rose xx% YoY in October, according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted).

Key factors impacted this performance:

High Inflation: Food inflation is decelerating but remains high compared to historical norms. This is lifting sales in value terms, but dragging down volumes, as cautious consumers pay close attention to budgets, reducing basket sizes.

Mixed weather: The warmest October since xxxx, with temperatures peaking at xx in the South East, supported grocery sales in the first half of the month, before the arrival of unsettled and wet conditions, including Storm Babet between 18 and 21 October.

Halloween preparations: The run-up to Halloween lifted confectionery sales (+15.3% in the four weeks to 4 November, NIQ), but supermarkets saw weaker demand for Halloween items and decorations as consumers pull back on non-essential spend.

Less eating out: Grocery retailers are benefiting from a redistribution of food spending as households cut back on restaurant meals and dine at home instead.

Consumer caution as peak season arrives

Food & Grocery sales rose less than expected in October (xxxx), with volumes remaining in negative territory (xxxx), as retail’s ‘Golden Quarter’ got off to a slow start.

The slowdown reflects easing food inflation but was also affected by consumers preserving their spending power ahead of the costly festive season.

Food inflation pulled back for the xxxx straight month, easing to xx% in October, from xx% in September, marking its lowest level since xxxxx xxxx (ONS).

While this is welcome news for consumers, prices are still xx% higher than they were two years ago.

The closely watched GfK consumer confidence index dropped nine points in October to -30, marking the sharpest month-on-month decline since December 1994 and erasing recent gains.

Although consumers are now operating in a lower inflationary environment compared to last year, the last 12 months have taken a toll on confidence and their ability to spend.

Alongside elevated interest rates, higher mortgage/rent payments, dwindling covid savings and the heating coming back on, beleaguered consumers are thinking very carefully about how they spend their money.

Take out a FREE 30 day membership trial to read the full report.

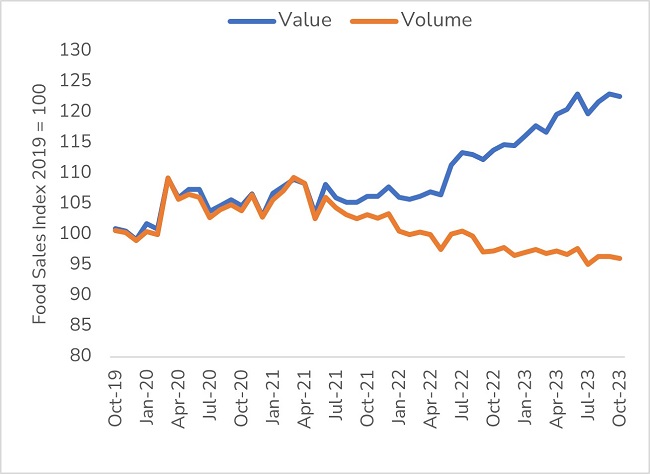

Food retail sales values and volumes diverge

Source: Retail Economics, ONS

Source: Retail Economics, ONS