UK Food & Grocery Sector Report summary

January 2024

Period covered: Period covered: 26 November - 30 December 2023

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Food & Grocery Sales

Food & Grocery sales rose xx% YoY in December, according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted).

Over the full festive period (November + December combined), Food & Grocery sales increased xx% YoY, contrasting with a dip in non-food retail sectors (xx%).

Key factors impacted this performance:

Cautious consumers: For the second Christmas in a row, consumers prioritised value amidst high energy and housing costs. Cautious shoppers bought fewer gifts and non-essentials, focusing on promotional activity to manage squeezed finances. However, Food & Grocery was shielded compared to other areas of retail, with consumers still willing to indulge in quality food for family celebrations.

Redistribution of spend: Grocery retailers are also benefitting from a transference of spend away from hospitality as households cut back on eating out and dine-in instead. Restaurant spending fell 8.8% YoY in December (Barclaycard).

Christmas Day timing: The timing of Christmas, falling on a Monday, provided an extra day (and full week) for shopping in the run-up compared to 2022. This led to a noticeable uptick in last-minute purchases, particularly in larger supermarkets. Shoppers embraced an omnichannel approach, balancing early online deliveries with in-store visits closer to the event for fresh and festive items.

Record-breaking Christmas

Food outperformed in December as families indulged in festivities. Supermarkets had their busiest Christmas since 2019, hitting a record £xx of sales in the four weeks to 24 December (Kantar).

Against a soft economic backdrop, shoppers sought value, gravitating towards promotions and own-brand lines.

Retailers responded by focusing their festive strategies on offering the best value propositions - price, quality, and loyalty rewards - to capture market share.

Promotional activity (unusually) increased in December, as retailers ramped up discounts on Christmas dinner essentials in a fiercely competitive market.

Take out a FREE 30 day membership trial to read the full report.

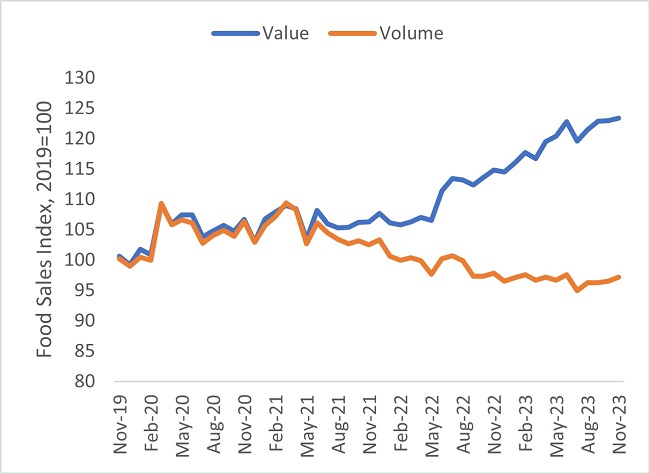

Food retail sales values and volumes diverge

Source: Retail Economics, ONS

Source: Retail Economics, ONS