UK Food & Grocery Sector Report summary

December 2023

Period covered: Period covered: 29 October – 25 November 2023

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Food & Grocery Sales

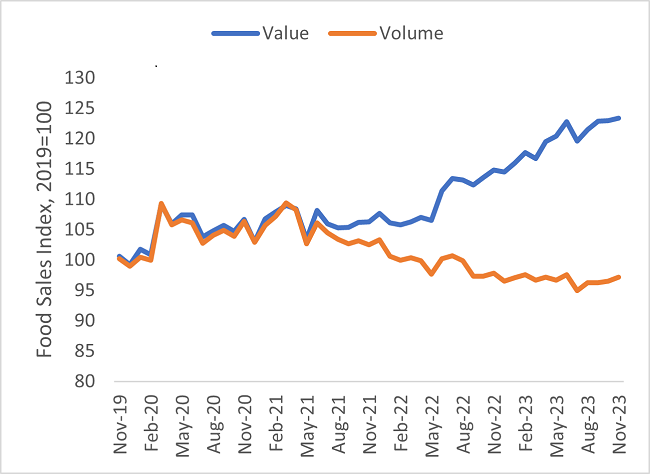

Food & Grocery sales growth eased marginally to xx% YoY in November from xx% in October, according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted).

Adjusted for inflation, volumes remain negative. But with food inflation dipping below double-digit rates for the first time since xxxx, volume declines are easing.

Key factors impacted this performance:

Persistent Inflation: Food inflation dipped below double-digit rates for the first time since mid-2022 in November (ONS), but ultimately persists at high levels. This continues to put pressure on the quantity of good bought, despite lifting sales in value terms, as shoppers attempt to manage squeezed budgets.

Redistribution of spend: Grocery retailers are benefiting from a transference of spending away from hospitality as households cut back on eating out to dine-in.

Flight to value: The rebalance of spending is principally benefiting those with a strong value proposition across price, quality and rewards, as shoppers look to make considered purchasing decisions amid the soft economic backdrop, including elevated interest rates and persistent above-target inflation.

Seasonal trends: Growing festivities see rising demand for indulgent food items in November, such as premium own-brand mince pies and warm beverages, as households embrace Christmas.

Cautious spending in Q4

The backdrop for grocery spending is improving on recent months, but there are uncertainties holding back an outright recovery in food volumes.

Inflation has fallen faster than expected in Q4 2023, but is set to persist above-target for longer than officials previously expected. Importantly, easing inflation means regular earnings have turned positive in real terms, despite slowing wage growth.

This has had a significant impact on consumer confidence. Although confidence remains decidedly negative, GfK’s index measure made a marked six-point improvement to -24 in November.

But the economic backdrop is evolving at pace, distorting headline figures and putting acute pressure on middle income consumers with debt.

Mortgagors are facing a jump in housing costs as interest rates remain elevated. Average fixed rate two-year mortgages (75% LTV) were at 5.3% in November. With around 1.6 million households exiting fixed rate mortgage deals in 2024 at average rates of 2%., average repayments are set to rise by around £220 per month.

Take out a FREE 30 day membership trial to read the full report.

Food retail sales values and volumes diverge

Source: Retail Economics, ONS

Source: Retail Economics, ONS