UK Electricals Sector Report summary

January 2024

Period covered: Period covered: 26 November - 30 December 2023

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Electricals sales

Electricals sales fell by xx% YoY in December, according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted) against a xx% decline a year ago.

This was the deepest decline in xx years and the xx consecutive decline, keeping it at the bottom of our growth rankings table.

Demand weak

The category was unable to replicate 2022’s cost-of-living induced spending towards energy efficient items, while typical computer items have fallen out of cyclical demand following strong pandemic spending.

Structural issues are also at play, including consumers holding onto phones, TVs and personal computers for longer as innovation wanes.

It’s also against a relatively strong performance a year ago when sales growth declined just 0.5% amid elevated inflation which supported top line sale growth.

Cautiousness is having a severe impact on the sector, as it competes for spending with other areas of the economy amid squeezed household budgets.

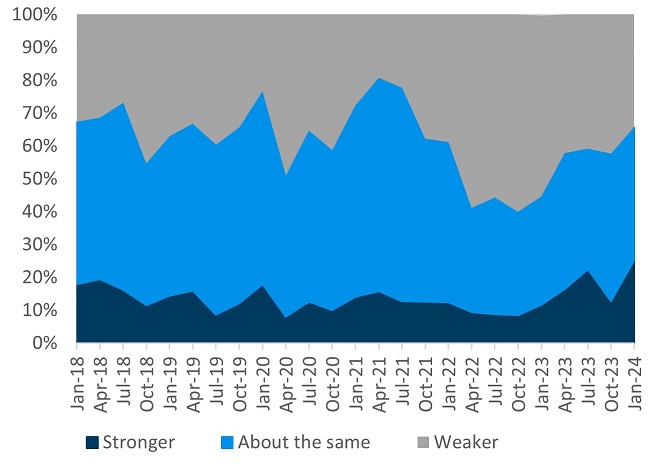

Three quarters of consumers say they became more cautious with their spending in Q4 2023 according to our latest Shopper Sentiment Survey.

Although this marks a slight improvement on an average of 78% throughout 2023, it is a considerable step up from a pre-pandemic average of 50%.

Households focused spending on typical gifting lines rather than big ticket items with little desire to purchase electrical goods despite a slight uptick in the index which measures consumers appetite to make major purchases in December.

Analysing spending over a two-month period across November and December provides a more robust picture of underlying demand during the Christmas trading period, to smooth out these peaks.

Using this measure shows electrical sales fell 6.3% across November and December, the weakest performing non-food category.

When households did splash out at Christmas, they did so across hospitality, leisure and travel. Christmas parties fuelled a 7.9% rise across pubs, bars and clubs spending in December, while Glastonbury ticket sales and cinema releases such as ‘Wonka’ boosted entertainment spending by 12.3% (Barclaycard). Restaurants remained in decline (-8.8%) but had its best performance since August.

Take out a FREE 30 day membership trial to read the full report.

Outlook for personal finances improves but caution remains

Source: : Retail Economics Shopper Sentiment Survey, January 2024, 2,000 nationally representative households

Source: : Retail Economics Shopper Sentiment Survey, January 2024, 2,000 nationally representative households