UK DIY & Gardening Sector Report summary

February 2024

Period covered: 31 December 2023 – 27 January 2024

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

DIY & Gardening Sales

DIY & Gardening sales fell by xx% YoY in January according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted).

ONS data shows the wider Household Goods category faced xxxx shop price inflation in January, pointing to a decline in sales volumes.

Sales volumes in the Household Goods category fell xx% YoY in the month (ONS).

DIY deprioritised

DIY & Gardening was the xxxx performing sector on an annual basis in January.

High living and borrowing costs, combined with the deprioritising of discretionary spending on home improvements, pushed down sales volumes in the month, despite flat shop price inflation.

Inflation was weaker than expected in January, remaining unchanged at 4.0%, below economists’ forecasts of 4.2%, with downward pressure coming from household goods.

Consumer confidence increased by three points in January to -19 as a result (GfK) , the highest rate since January 2022, albeit firmly in negative territory, while GfK’s major purchase index also increased three points to -20.

Despite this, households remain cautious and highly selective with their discretionary spending, particularly in light of high borrowing costs.

Research by Retail Economics and NatWest found that spending on home-related products is less of a priority for households than other areas such as holidays, which are still enjoying a post-pandemic rebound in consumption.

Strong garden centre sales

The Garden Centre Association (GCA) recorded robust January trading figures, with overall sales at garden centres climbing xx% YoY.

Spending on hard landscaping (+xx%) was the strongest, followed by outdoor plants (+xx%) and seeds & bulbs (+xx%), reflecting time spent cultivating winter gardens despite largely inclement weather in the month.

However, furniture and barbecues saw sales fall by xx%, as households hold back from big-ticket purchases at this time of the year.

Take out a FREE 30 day membership trial to read the full report.

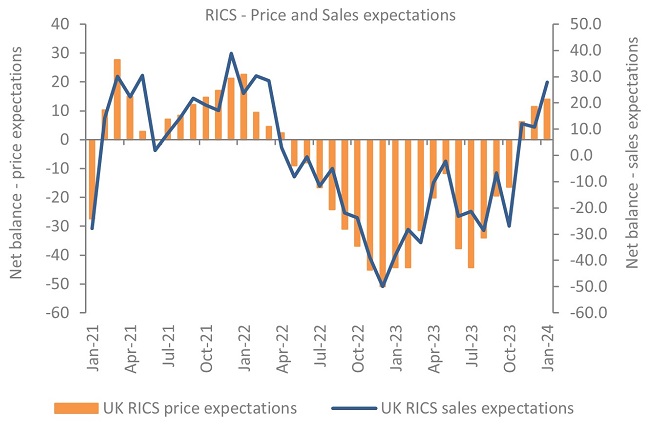

Prices and sales expectations improve

Source: RICS

Source: RICS