RICS Residential Market Survey March 2020

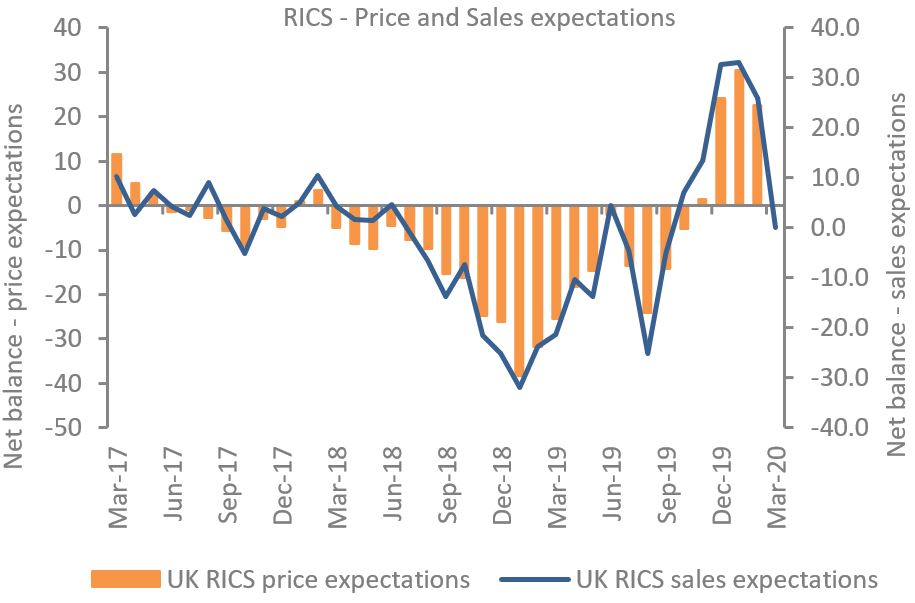

RICS’s latest survey among estate agents shows March was a turbulent period for the housing market. Confidence had started to flow back into the housing market following the general election at the end of last year, however lockdown measures have now brought activity to a near standstill.

Surveyors are unable to come out to peoples’ homes, estate agents cannot give prospective buyers viewings and sellers do not want strangers in their homes. Meanwhile, the British Association of Removers has told removal men to cancel or postpone scheduled house moves.

Concerningly, the measures on future house sales and prices are negative not just in the short term, but also at the twelve-month horizon, suggesting that a return to ‘normality’ is likely to take time, not least because households remain cautious.

Indeed, Retail Economics’ latest fortnightly coronavirus survey shows that almost a quarter (23%) of consumers think that normality in their lives will not return for at least another year, which will inevitably impact intentions over the next 12 months.

RICS has called for the government to explore measures to support housing activity, including a stamp duty holiday – a call it says it would not do “on a whim”.

Source: RICS

Buyer and seller activity plummets

RICS’s survey shows that homes being listed for sale dropped sharply in March, with a net balance of -72% of estate agents reporting a fall following three months of increases. This brought the average number of listings on agents’ books at a record low of 40 properties per branch.

New buyer enquiries also plummeted in March following three months of gains, with a net balance of -74% reporting a decrease in demand during the month.

In turn, agreed sales plunged to a net balance of -69% of agents reporting a decline in March, down from +19% in the previous month.

With supply limited and prices feeding through from previous months’ activity, a net balance of +11% of participants reported house price growth in March, with Northern Ireland, Scotland and the South West recording the strongest gains.

Ongoing activity at a near standstill

Looking ahead, near term price expectations plummeted in March to a net balance of -82% expecting declines over the next three months, down from a +21% net balance in February.

Sales expectations also tumbled, with a balance of -92% expecting sales to decline over the next three months – representing the weakest figure since the series began in 1998.

At the twelve-month horizon, expectations are somewhat less downbeat. A balance of -38% of respondents predict house prices will fall over the year, while -42% of contributors expect sales to be down.

Rentals slip

In the lettings market, rental demand was broadly stable in March, but landlord instructions fell back once again, seeing a net balance of -32% of respondents noting a decline.

Although rents are expected to slip, an average annual growth of 2.5% is anticipated through to 2025.

Back to Retail Economic News