RICS Residential Market Survey July 2020

All activity metrics saw a substantial pick up in July according to RICS’s latest Residential Market Survey, boosted by the stamp duty holiday (introduced from 8th July).

Buyer and seller activity rises further

- RICS recorded a net balance of +75% of agents saw a rise in new buyer enquiries in July, rising for the second consecutive month.

- Similarly, a net balance of +59% reported a rise in the number of new properties being listed for sale, up from +41% recorded in June.

- A further pick up was seen in newly agreed sales, with a net balance of +57% experiencing an increase in transactions in July, with positive readings recorded across all parts of the UK.

Source: RICS

Prices rise for first time since March

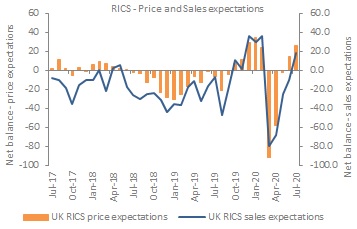

- Encouragingly, the headline price growth indicator moved into positive territory for the first time since March.

- A net balance of +12% of agents noted an increase in prices in July, a significant improvement on the -13% recorded in the previous month.

- Most regions/countries reported a rise with London the only one to have a negative net balance (-10%) although this was a vast improvement on June’s -54%.

- This follows data from Halifax which reported that house prices fell 0.2% quarter-on-quarter in July, the best result since April.

- On a monthly basis, Halifax saw UK house prices jump 1.6% in July, the strongest rise since December 2019. Compared to last year, prices were 3.8% higher, with the average house price at £241,604 – a record high.

Short-term outlook improving, but caution remains further out

- A net balance of +8% expect prices to increase over the next three months, while agents anticipating a flat to marginally positive trend in national house prices over the next year.

- Agents expect transaction levels to improve with a net balance +26% anticipating an increase in sales in the next three months

- However, the longer-term view remains in negative territory with a net balance of -10% expecting sales to fall over the year ahead.

- Indeed, the challenging economic climate, with the end of the furlough scheme fast approaching, is expected to weigh on market activity.

Landlord instructions rise for first time since 2016

- In the lettings market, tenant demand recovered further in the three months to July with a net balance of +35% of contributors seeing an increase.

- Landlord instructions picked up, with a net balance of +6% - the first positive reading since 2016.

- Agents predict rental growth of around 1% nationally over the year ahead

Back to Retail Economic News