RICS Residential Market Survey December 2019

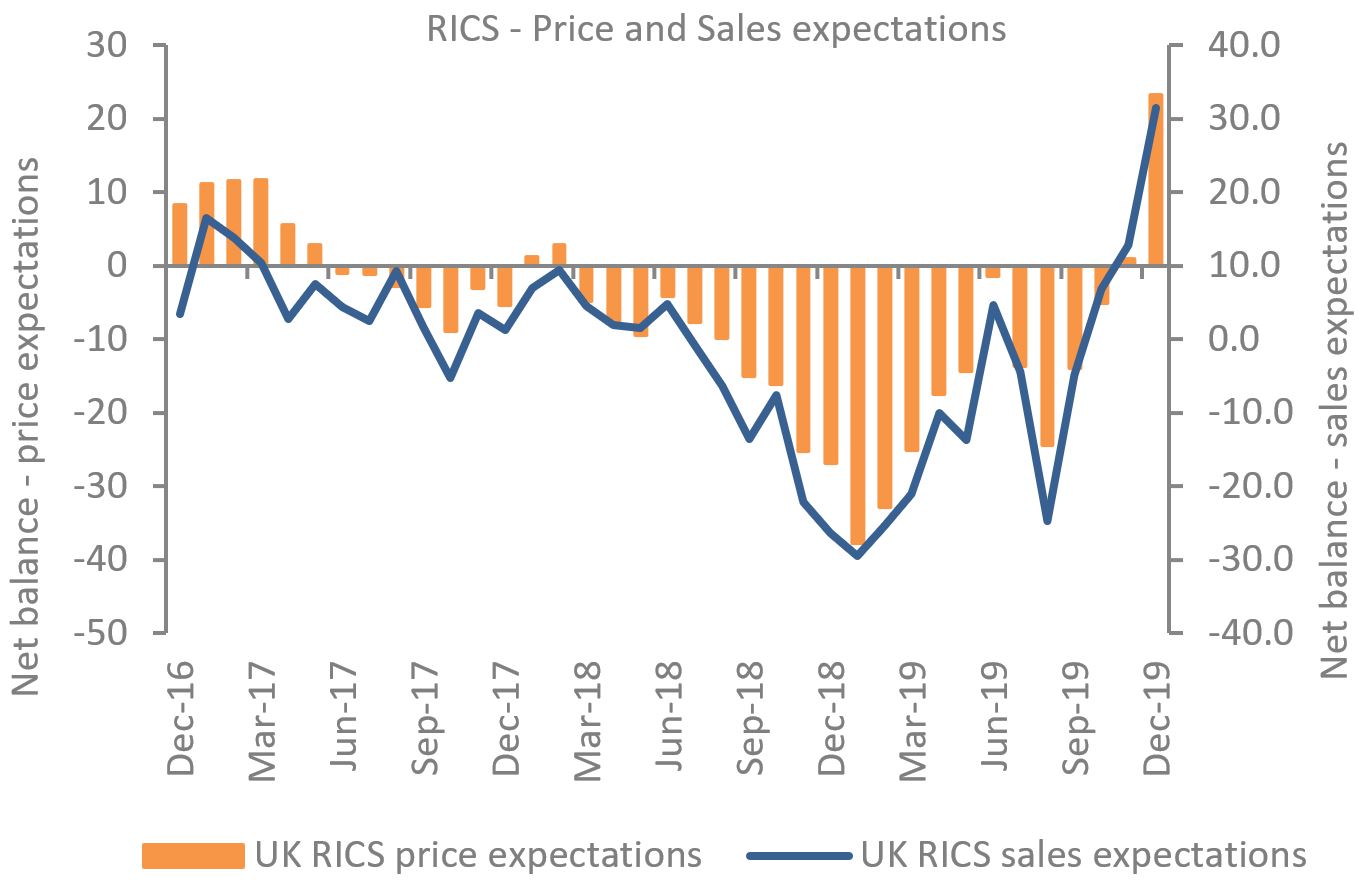

RICS has reported an uplift in housing market activity following the Conservative government win. New instructions to market properties, as well as buyer demand and agreed sales, moved into positive territory in December, with activity expected to flurry in a year’s time.

Source: RICS

Election boost

New instructions picked-up at the national level, with a net balance of +9% of estate agents reporting an increase, driven by activity in London and the South East. Instructions were broadly flat elsewhere.

New buyer enquiries rose to a balance of +17% of respondents reporting an uplift from -5% in November. It was noted that London and the South East made a particularly strong turnaround following negative results in the previous month.

Agreed sales were up to +9% in December, marking the first positive reading since June 2019. London and East Anglia were among the strongest improvements., while sales reportedly weakened in Northern Ireland and Scotland.

The housing market in the capital has been particularly vulnerable to Brexit uncertainty, as well as the possibility of higher taxes on properties depending on the election outcome.

RICS’s house price balance rose to -2% in December. Respondents continue to expect a modest softening in house prices across the South East, London and East Anglia for now though, with prices in Northern Ireland and Scotland remaining relatively strong.

Expectations uplift

Looking ahead, price gains are expected across all parts of the UK. A net balance of +61% anticipate price increases a year down the line, with a turnaround expected in London and the South East.

Sales expectations are also more positive, with a net balance of +31% expecting rises in the next three months and +61% expecting rises in 12 months.

Elsewhere in the lettings market, increasing tenant demand continues to come up against declining rental stock. As a result, projections suggest rental growth will be in the region of 2% over the coming year.

Back to Retail Economic News