ONS Labour Market April 2021

The latest ONS data shows a modest decrease in the unemployment rate as inactivity edged up in the December to February period, while tight Covid-related restrictions saw a decline in total hours worked

Hours worked stall

- Lockdown measures have stalled the recent recovery in total hours. Between December 2020 and February 2021, total actual weekly hours worked was 959.9 million hours in the UK. This marked a decrease of 20.1 million, or 2.1%, from the previous quarter.

Unemployment dips as inactivity rises

- In the quarter to February, the unemployment rate was estimated at 4.9%. While this is 0.9 percentage points higher than a year earlier, it marks a 0.1 percentage point decline on the previous quarter.

- The ONS attributed the fall to a large volume of men leaving the jobs market altogether. The economic inactivity rate for men was at a joint record high of 17.5% (the highest since July 2011).

- This saw the overall inactivity rate rise by 0.2 percentage points to 20.9% in the three months to February – up 0.7 percentage points on last year. It follows a similar pattern to the first lockdown a year ago.

Employment falls

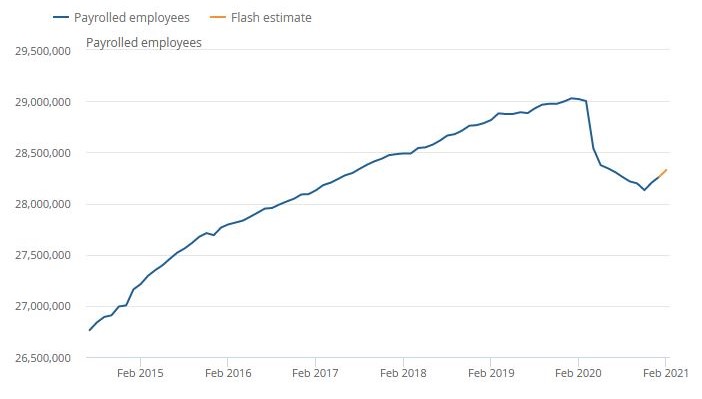

- Early estimates for March 2021 indicate that there were 28.2 million payrolled employees, representing a fall of 2.8% compared last year and a decline of 813,000 people over the 12-month period.

- There were some 56,000 fewer people in payrolled employment in March 2021 when with a month earlier – marking a decrease of 0.2% and the first monthly decline in four months.

- This pushed up the total number of payrolled jobs lost since the onset of the pandemic to 813,000 – 53,7% of which were held by people aged under 25, with hospitality and London particularly hit hard.

- The employment rate was estimated at 75.1% in the three months to February – 1.4 percentage points lower than a year earlier and 0.1 percentage points lower than the previous quarter.

Payrolled employees, seasonally adjusted, UK, July 2014 to March 2021

Source: HMRC

Job ads pick up as lockdown eases

- The number of job vacancies in January to March 2021 fell by 22.7% on last year at 607,000 vacancies – with arts, entertainment and recreation, and accommodation and food services the worst affected.

- But experimental single-month data indicates a strong increase in March and experimental statistics of online job adverts from agency Adzuna suggest a potential uplift in April. The data shows a marked increase in sectors such as hospitality, which reopened for outdoor business last week.

Earnings rise

Annual growth in average employee pay has strengthened, with the growth driven in part by compositional effects from a fall in the number and proportion of lower-paid jobs. For February in nominal terms:

- Average regular pay (excluding bonuses) for employees in Great Britain was £534 per week before tax and other deductions from pay – up from £511 per week a year earlier.

- Average total pay (including bonuses) for employees in Great Britain was £568 per week before tax and other deductions from pay – up from £546 per week a year earlier.

- Total pay and regular pay is growing at a faster rate than inflation, at 4.5% and 4.4% respectively in the three months to February compared to a year earlier

- The ONS estimates that when removing the compositional effect of fewer lower-paid jobs, the underlying wage growth is around 2.5% for total and regular pay

Great Britain average weekly earnings annual growth rates, seasonally adjusted, January to March 2001 to December to February 2021

Source: ONS

Back to Retail Economic News