UK Retail Sales Report summary

October 2021

Period covered: Period covered: 29 August – 2 October 2021

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Retail sales eased to a 0.00% rise in September YoY, according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted, exc. Fuel); and rose by 0.00% against 2019 levels.

The softening of retail sales of late partly reflects base effects from comparisons to robust sales last year. Crucially though, mounting pressure from spending outside of retail, rising inflation and supply chain challenges are putting pressure on propensity to spend in retail going into the golden quarter.

BP and Esso’s warning on 23 September of a small number of forecourt closures amid HGV driver shortages that created significant shockwaves, as consumers prioritised stocking up on motor fuels in the subsequent weeks that followed.

Work-related expenses, which includes fuel spending, shot up a staggering 0.00% year-on-year in the days that followed, according to Bank of England data.

Shoppers reluctant to drive to shopping locations to view and collect heavy goods had an acute impact on big ticket items such as furniture and home-related items. 0.00 months of consecutive growth came to an end for DIY & Gardening sales, while Furniture & Flooring sales (0.00%) turned negative for the first time since February’s lockdown, and declines deepened for Homewares (0.00%).

Going into the golden quarter, retailers are facing a harsh macroeconomic environment, which is putting pressure on prices and driving inflationary concerns among consumers.

Pressure in the supply chain is pushing up production costs – impacting retailers across the board. Such costs take time to filter through to consumer prices (CPI), but consumers are already bracing the impact.

Retail Economics’ research shows that two thirds (67%) of consumers are now concerned about rising costs of living. This is up from 54% last month, with concerns about inflation now at the highest level in more than five years.

Some retailers are better placed to absorb costs than others. The shift towards online is a significant contributing factor of dwindling profit margins. Pure online retailers typically operate on considerably lower margins than multichannel and brick-and-mortar business models. For pure-online Clothing retailers, average pre-tax margins have fallen from more than 0.00% in 2009/10 to around 0.00% now.

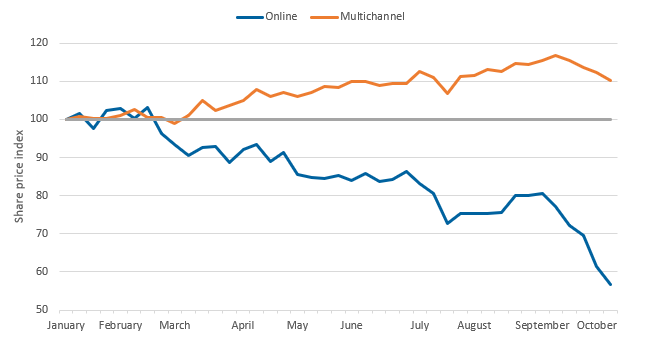

The price-led nature of e-commerce has seen investor sentiment dwindle among pure-online players, more so than store-based retailers.

Since the start of the year, share prices among listed online retailers have fallen 0.00%, while share prices among multichannel players has ticked up 0.00% (see chart below).

Take out a FREE 30 day membership trial to read the full report.

Recent cost pressures have disproportionately impacted market sentiment for online retailers

Source: Retail Economics analysis, share price index weighted by market capitalisation, 05/01/21=100, sample-51 retailers

Source: Retail Economics analysis, share price index weighted by market capitalisation, 05/01/21=100, sample-51 retailers