UK Retail Sales Report summary

May 2022

Period covered: Period covered: 03 April – 30 April 2022

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Retail sales increased by just 0.8% YoY in April against a 00% rise in the previous year, according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted, exc. Fuel). The reopening of stores following the third national lockdown provided a tough comparison on an annual basis.

Consumer sentiment

Consumer confidence has taken a battering in recent months which is impacting perceptions of the economy and personal finances. UK consumer confidence fell to its lowest on record (since 1974) at -40 in May according to GfK data.

Inflation has long been in the pipeline, but personal finances came under growing pressure in April, driven by the step up in Ofgem’s energy price cap, VAT returning to 20% for hospitality, and the National Insurance Contribution rise.

Pressure on supply chains is being intensified by the Russia-Ukraine war, leading to delays and doubts over food and energy security.

The resultant shattering of confidence is normally associated with cutbacks in spending, with the cost of living crisis already seeing consumers adopt recessionary behaviours, including a flight to value.

But the combined impact of pent-up demand with lifted Covid restrictions and battling with growing cost of living pressures is leading to significant and mixed changes in the composition of household finances and spending.

Savings

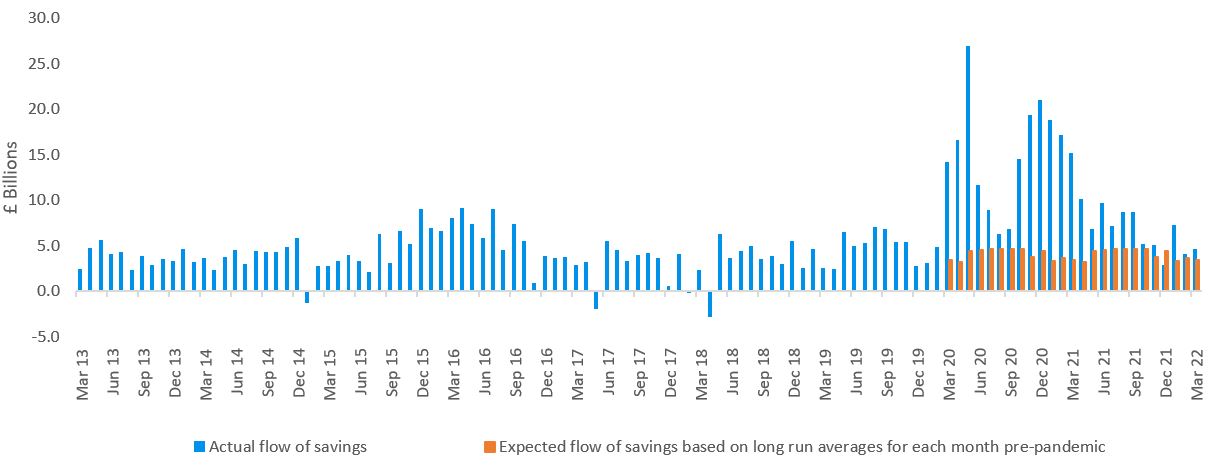

Household savings accelerated during the pandemic. Using Bank of England data, Retail Economics estimates that consumers deposited an excess of £00 billion in the two years to end-March 2022, compared with expectations based on long run averages.

But excess savings are heavily concentrated to households in the top 00% wealthiest households. Additionally, looking at monthly changes in personal finances by household shows that more affluent households are able to better absorb inflation.

Monthly personal finances

Retail Economics’ monthly Cost of Living Tracker shows the least affluent faced the highest levels of inflation at 00% YoY in April, as well as the weakest earnings growth at 00% YoY in the month. This has seen the least affluent face severe declines in their income available for non-essential purchases, with their discretionary income down -00% year-on-year in April. By comparison, earnings growth of 00% has better supported income levels for high affluence households despite inflation being at a 40-year high.

This means that as the UK approaches its first summer in three years with no Covid restrictions, more affluent households are likely to be able to release pent up demand for holidays, leisure and recreation despite rising living costs. Meanwhile, low and low-middle affluence households are driving a cut back in non-essential spending and trading down.

These consumers are turning to discounters to reduce essential costs. Aldi and Lidl market share has grown markedly over the past few months. Aldi’s market share rose 00% in October 2021 to 00% in May, while Lidl’s share grew from 00% to 00%.

Retail Economics estimates that Aldi has seen an acceleration of market share of 00 months because of the cost of living crisis, while Lidl has seen an acceleration of 00 months.

Take out a FREE 30 day membership trial to read the full report.

Excess savings have been built up during the pandemic

Source: Bank of England, Retail Economics analysis

Source: Bank of England, Retail Economics analysis