UK Retail Sales Report summary

July 2022

Period covered: Period covered: 29 May – 02 July 2022

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Retail sales ticked up 00% YoY in June according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted, exc. Fuel), against 00% growth a year earlier. Despite extended bank holiday celebrations in June, persistent high inflation and the recovery of services is deteriorating retail spend.

Short-lived Jubilee boost

The Queen’s Jubilee celebrations at the start of June brought only temporary relief to recent pressures that have mounted against retail spending. Street parties and gatherings over the long bank holiday Jubilee weekend supported a 00% rise in food sales in June. It saw shoppers spend an additional £00m on food and grocery during the week to 5 June, with alcohol sales up by a third compared to the average in 2022.

Inflation deteriorating cash

High spirits soon soured as inflation surged to 00% YoY in June across the consumer basket. Inflation at 40-year highs has left the typical family with around £00 less cash per month in June to spend on non-essential purchases (Retail Economics-HyperJar Cost of Living Tracker).

Mitigating rising living costs

It’s seeing households make sacrifices when it comes to essential spending. Petrol and diesel fuel prices accelerated to record highs in June, and remain close to records into July. The impact of such rises is seeing priorities shift across food spending. A survey shows that 00% of the population reported buying less food in the first half of July as a result of soaring prices.

In an effort to mitigate the cost of living squeeze, consumers are shopping around for low prices and avoiding delivery costs. This has brought modest improvements in footfall in recent months. Footfall was down by 00% on 2019 levels in June, marking an improvement on the 00% drop in May.

Prioritising spend elsewhere

But rising living costs do not impact households equally. More affluent households who are better able to absorb rising costs through earnings increases are looking to release pent up demand for holidays, leisure and recreation this summer. This has seen spending on travel agents (+00% in June vs. May), airlines (+00%), and hotels, resorts, and accommodation (+00%) continue to grow.

It means that when consumers do look to spend on non-essentials, they are placing greater focus on services, which has put non-food retail sales in a second consecutive month of decline according to Retail Economics data.

Costs ahead

As inflation persists and interest rates continue to edge up, even those who are not financially struggling are reflecting on their retail spend, with 00% of consumers planning to cut back their spending over the next year.

Take out a FREE 30 day membership trial to read the full report.

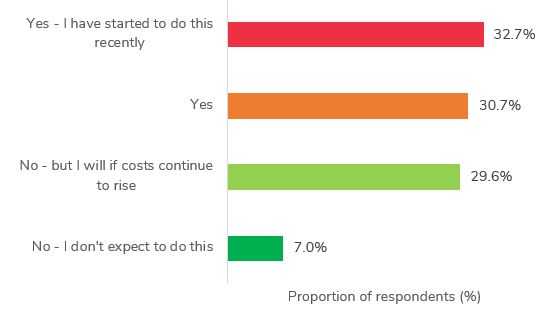

Have you started to strictly limit the amount you spend on your weekly food shop as a result of rising living costs?

Source: Retail Economics-HyperJar Cost of Living Tracker, July 2022

Source: Retail Economics-HyperJar Cost of Living Tracker, July 2022