UK Retail Sales Report summary

February 2022

Period covered: Period covered: 02 January – 29 January 2022

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Retail sales soared 00% YoY in January according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted, exc. Fuel), as Omicron fears subsided.

Underlying sales robust but uneven

The government has been keen to keep the variant’s hit on the economy short-lived, with consumer spending shored up by more relaxed Covid measures from mid-January.

Improving willingness to venture out supported non-food (00% YoY), driven by a rebound across home-related categories against mandated store closures a year earlier.

Apparel and Health & Beauty also staged a strong recovery, following self-imposed lockdown-style behaviour in December as families looked to avoid catching Covid ahead of Christmas.

By contrast, grocery retailers are now at the other end of the spectrum having previously benefited from stay-at-home lifestyles. Food sales declined 00% YoY in January as pre-pandemic behaviours re-emerge.

As Covid-19 fears fade, consumers have growing concerns about rising living costs this year as inflation is at a 30-year high (5.5% CPI in January). This is eroding confidence.

Spending intentions are set to face headwinds from persistent inflation, as well as tightening across fiscal and monetary policy, including April’s National Insurance Contribution rise and rising interest rate expectations.

The Bank of England warned in January that households are about to suffer the sharpest fall in living standards since records began three decades ago. This will disproportionately impact the poorest households.

Impact of hybrid working on retail

As the government looks to ‘live with Covid’ from January, considerable lifestyles changes since the pandemic have become embedded, such as hybrid working.

Since the pandemic, structural shifts in the labour market from greater levels of home working have driven online sales growth. In the UK a 00 of consumers increasingly work from home since Covid-19. This has resulted in higher first time delivery success rates, giving consumers greater confidence and convenience in home shopping.

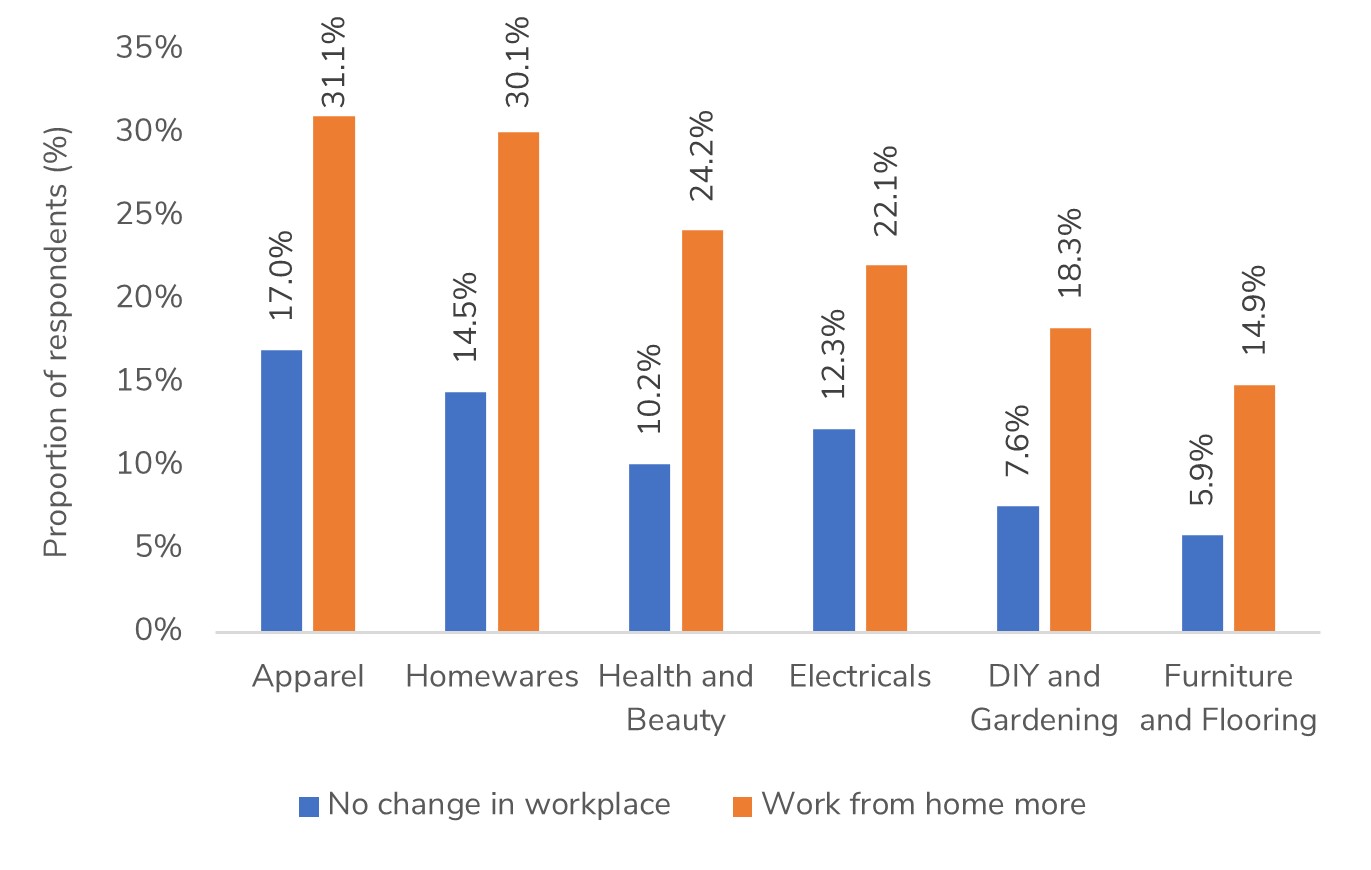

Consumers working from home are more than 00 as likely to make a permanent shift online even after Covid subsides, compared to those that have not experienced changes in their workplace. This is happening across retail categories. Work from home consumers are also more willing to pay for home delivery and returns services.

Additionally, home workers are most likely to reduce store visits in the future. On average in the UK, 00% of consumers working from home more expect to cut back on store visits going forward, compared with 00% of those who have not faced workplace changes.

Take out a FREE 30 day membership trial to read the full report.

As a result of Covid-19, what shopping did you shift online during the pandemic that you expect to become permanent?

Source: Retail Economics, Metapack

Source: Retail Economics, Metapack