UK Retail Economic Briefing Report summary

September 2021

Period covered: Period covered: August 2021

2 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Economic activity

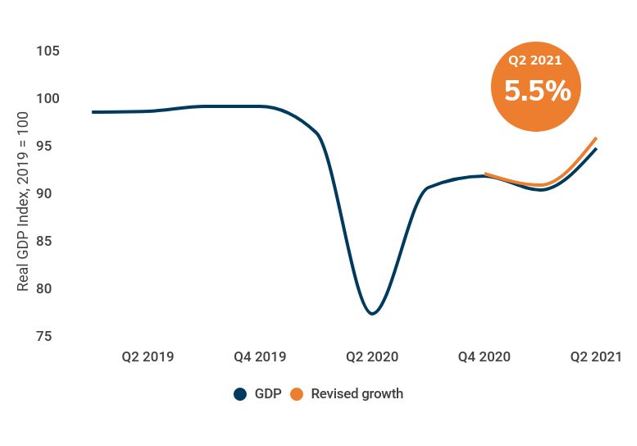

GDP increased by 5.5% quarter-on-quarter in Q2 2021 (April-June), revised up from the initial estimate of 4.8% growth.

The level of economic activity in the UK is 00% below where it was prior to the pandemic at the end of 2019.

UK GDP is forecast to grow by 00% in 2021 overall, according to independent forecasts from the Treasury.

Inflation

CPI inflation jumped to 00% YoY in August. The 1.2 percentage points (pp) rise on the previous month was the largest since records began in 1997.

While much of the rise was driven by base effects a year ago, ongoing shortages of labour and disruptions within the supply chain will continue to exert upward pressure going forward.

Retail Economics research shows consumers’ concerns about inflation are now at the highest level in more than five years.

Confidence

UK business confidence rose by 10 points in September to 46%, the highest since 2017 (Lloyds).

There are obvious challenges ahead for businesses in terms of labour availability and supply chain issues. It remains to be seen what impact this will have on confidence in the coming months

GfK’s Consumer Confidence score decreased by five points to -13 in September. Disappointingly, this falls back below pre-pandemic levels and is the weakest since April.

Housing market

Activity in the housing market cooled in August as stamp duty relief was scaled back.

The number of mortgage approvals fell during the month, totalling 00 from 75,126 in July, the lowest level since July 2020 but still ahead of pre-pandemic levels. Compared with the same month a year ago, mortgage approvals fell by 15%.

Demand is expected to remain healthy as we head into the final quarter of 2021, in the absence of further shocks from the pandemic. Low mortgage rates, lack of housing stock, accumulated lockdown savings and a robust labour market will continue to support activity.

Take out a free 30 day membership trial to read the full report >

Economic growth revised up in Q2 2021

Source: ONS

Source: ONS