UK Retail Economic Briefing Report summary

October 2021

Period covered: Period covered: October 2021

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Economic activity

The UK economy picked up in August as accommodation, restaurants and festivals benefited from the first full month without Covid-19 restrictions in England.

GDP is estimated to have grown by 0.00% in August, regaining momentum following an unexpected 0.1% fall in July. The economy is now 0.8% below February 2020’s pre-pandemic levels.

Staycations and pent-up demand for leisure activities provided a welcome boost to consumer-facing services, but manufacturing and construction industries are showing weakness as supply shortages drag on growth.

The economic recovery faces more headwinds in the final quarter, as households and businesses grapple with steep price rises, notably fuel and energy.

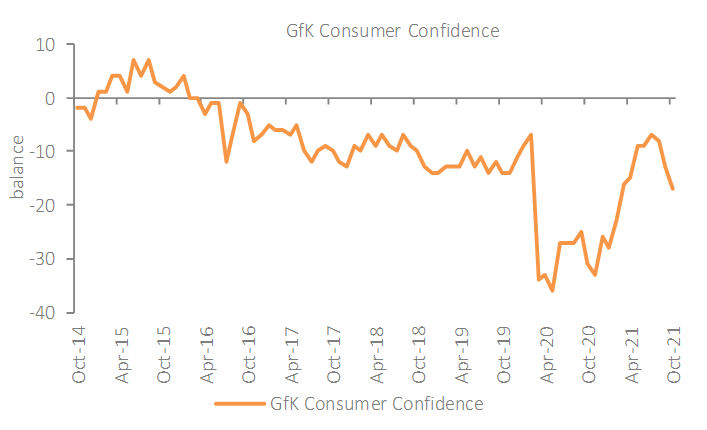

Confidence

GfK’s Consumer Confidence score fell by four points to 0.00 in October – the lowest level since February.

After six months of robust recovery in the first half of 2021, consumer confidence has taken a turn for the worse with all vital signs weakening.

Business confidence edged lower by 3 points to 0.00% in October, but was still the second highest since the pandemic began, according to the Lloyds Business Barometer.

Inflation

Inflation unexpectedly eased in September driven by base effects last year as the Eat Out to Help Out Scheme ended.

CPI inflation dipped in September to 0.00% YoY, from 3.2% last month. This was below economists expectations of inflation remaining stable.

Next month, inflation is expected to surge as the 12% rise in the energy price cap is reflected in the numbers. Increases in other goods and services as a result of ongoing supply chain disruptions will also push up inflation.

Retail Economics research shows that 0.00 of UK consumers are worried about rising living costs, up from 54% the previous month.

Labour Market

The labour market continues to recover; unemployment is dipping while the number of people on company payrolls exceeded pre-Covid levels as vacancies hit a new record high.

The unemployment rate in the UK edged down to 0.00% in the three months to August, from 4.7% previously. This is 0.5 percentage points (pp) higher than before the pandemic.

Between July and September, the number of vacancies rose above one million for the second consecutive period at 0.00 – some 318,000 above its pre-pandemic January to March 2020 level.

In the months ahead, some adjustment in the labour market is likely to take place as the full extent of the end to the furlough scheme is reflected in the numbers.

Take out a FREE 30 day membership trial to read the full report.

Consumer confidence on the decline

Source: GfK

Source: GfK