UK Retail Economic Briefing Report summary

November 2020

Period covered: Period covered: 01 Oct 2020 – 31 Oct 2020

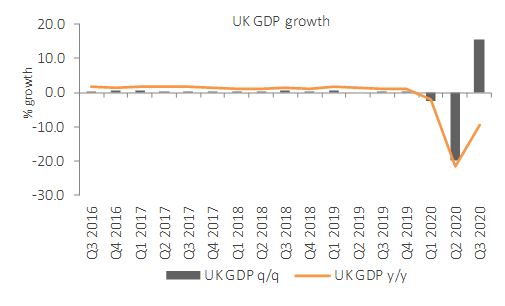

GDP rose by a record 15.5% in Q3 2020 compared to the previous quarter as lockdown measures were eased. Compared with the same quarter a year ago, the UK economy fell by 9.6%.

Services, production and construction output all rose by record quarterly increases in Q3 2020, up by 14.2%, 14.3% and 41.7% respectively.

Inflation

CPI inflation picked up in October, rising by 0.7% year-on-year, up from the 0.5% rise in the previous month – above market expectations of a 0.6% rise.

Eight categories contributed upward pressure in October, totalling 0.24 percentage points (pp) outweighing downward contributions of 0.10pp from four categories.

Average weekly earnings for employees rose in September, rising by 1.9%, improving on the previous period.

Retail Sales Growth

Retail sales rose by 6.0% in October, year-on-year, according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted, exc. Fuel) – strongest performance for over a decade.

Consumers became increasingly nervous about the potential disruption over Christmas as regional lockdown measures became more widespread & fear increased over a second wave.

Consumer Confidence

GfK’s Consumer Confidence fell by two points to -33 in November, -19 points lower than in the same month a year ago and the lowest reading since May.

Three measures within the index decreased compared to the previous month while two remained unchanged.

Tighter restrictions and rising cases of the coronavirus weighed on the index in November.

Record rise in GDP in third quarter

Source: ONS

Source: ONS