UK Retail Economic Briefing Report summary

December 2020

Period covered: Period covered: 01 Nov 2020 – 27 Nov 2020

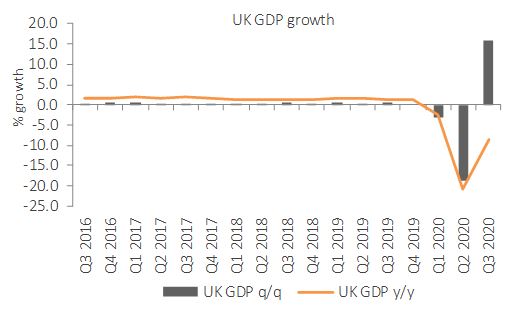

GDP rose by 15.5% in Q3 2020 on the previous quarter – a record high. Consumer spending rose by 18.3% in Q3 2020, compared to Q2 2020. The Consumer Price Index rose by 0.7% in October, up from the 0.5% rise in the previous month. The unemployment rate stood at 4.8% in the three months to September. Average earnings growth rose by 1.9% in the three months to September (regular pay).

Macroeconomic Indicators – GDP

GDP rose by a record 15.5% in Q3 2020 compared to the previous quarter as lockdown measures were eased. Compared with the same quarter a year ago, the UK economy fell by 9.6%. Services (+14.2%), Production (+14.3%) and Construction (+41.7%) output all rose by record quarterly increases in Q3 2020. Despite the sharp rise, the economy is still 9.7% below pre-pandemic levels in Q4 2019.

Retail Economics Retail Sales Index – October 2020

Retail sales rose by 6.0% in October, year-on-year, according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted, exc. Fuel) – strongest performance for over a decade.

Coffer Peach Business Tracker – October 2020

The Coffer-Peach Tracker monitors sales for the UK Pub and Restaurant sector, collecting and analysing monthly performance data from 56 operating groups. Total sales deteriorated in October, falling by 33.9% year-on-year, with like-for-like (LFL) sales falling by 28.9%. Total sales were stronger outside of the M25, down 31.9%, compared with a 39.5% decline in London.

Disposable income

Macroeconomic Indicators – UK Inflation October 2020

CPI inflation picked up in October, rising by 0.7% year-on-year, up from the 0.5% rise in the previous month – above market expectations of a 0.6% rise. Eight categories contributed upward pressure in October, totalling 0.24 percentage points (pp) outweighing downward contributions of 0.10pp from four categories. The largest upward contribution to the change in the 12-month inflation rate came from Clothing & Footwear, with prices rising by 2.8% between September and October this year, compared with a 0.8% fall a year ago.

Macroeconomic Indicators – Labour Market

The latest ONS labour market data shows a slight drop in the number of PAYE employees on the previous month, while redundancies hit record highs as unemployment rates rise. (Note: ONS made methodology changes this month accounting for coronavirus impacts). The number of paid employees fell by some 782,000 in October compared with March 2020 according to flash estimates using PAYE data – around 33,000 lower than in September. Total hours worked showed further signs of recovery in the three months to September 2020, recording a record rise of 83.1 million hours on the quarter to 925.0 million.

Macroeconomic Indicators – Earnings

For September 2020 in nominal terms (i.e. unadjusted for inflation): Average regular pay (excluding bonuses) for employees in Great Britain was £523 per week before tax and other deductions from pay – up from £509 per week a year earlier. Average total pay (including bonuses) for employees in Great Britain was £553 per week before tax and other deductions from pay – up from £542 per week a year earlier.

Credit and Housing Market

Annual growth in secured lending was broadly unchanged in October, rising by 2.7% year-on-year. The monthly change in the additional amount households borrowed totalled £4.3bn, lower than the £4.9bn in the previous month but remaining above the previous six-month average of £2.4bn. Mortgage approvals accelerated in October to 97,532 up from 92,091 in the previous month and significantly ahead of the previous six-month average of 51,810. This was the sharpest rise in mortgage approvals since September 2007.

Consumer Confidence – November 2020

GfK’s Consumer Confidence fell by two points to -33 in November, -19 points lower than in the same month a year ago and the lowest reading since May. Three measures within the index decreased compared to the previous month while two remained unchanged. Tighter restrictions and rising cases of the coronavirus weighed on the index in November. Indeed, weaknesses emerged in both personal finances measures, resonating with our own survey data carried out in October.

Record rise in GDP in third quarter

Source: ONS

Source: ONS