UK Online Retail Sales Report summary

September 2021

Period covered: Period covered: 1- 28 August 2021

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Online Sales Growth

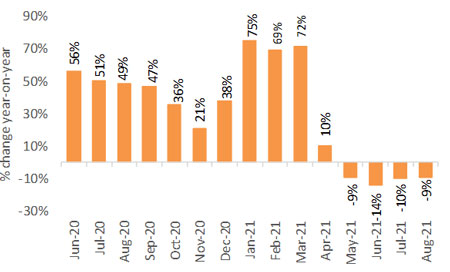

Online retail sales fell by 00% year-on-year (value and non-seasonally adjusted) in August against a 55.1% rise a year ago.

July’s feel-good factor continued into August with the first full month of relatively few Covid-19 restrictions boosting confidence amongst consumers.

Data from Google search suggests keywords such as ‘men’s suits’ and ‘wedding guest dress’ were at their highest level in over 17 years in August – a key indicator of intent.

Online Food declined marginally in August, falling by just 00% YoY against a 93.8% rise a year ago. Against pre-pandemic levels, sales growth rose by 93.8% in August.

The average basket size online was almost £17 lower than at the start of the pandemic, totalling £00 (Kantar).

Footfall improves

As more consumers ventured out, footfall levels recovered, declining by 18.4% in August on pre-pandemic levels having fallen by 24.2% in July.

Big cities outside London recorded an improvement almost double that of smaller high streets, benefitting from a greater array of activities on offer as daytrips rose during the summer holidays.

Against this backdrop, the online channel remained in decline, albeit recording its best performance since May, accounting for 25.5% of overall retail sales.

As more consumers ventured out, footfall levels recovered, declining by 18.4% in August on pre-pandemic levels, having fallen by 24.2% in July. Big cities outside London recorded an improvement almost double that of smaller high streets, benefitting from a greater array of activities on offer as daytrips rose during the summer holidays.

Clothing supports growth

Online Clothing & Footwear 00% was supported by more opportunities to socialise with a rise in weddings and gatherings boosting desire to buy new outfits. A gradual return to office working was also a key driver with demand for formalwear increasing.

Google search data suggests keywords such as ‘men’s suits’ and ‘wedding guest dress’ were at their highest level in over 17 years in August – a key indicator of intent.

Digital first environment

In our final deep dive we look at the most pressing themes facing the retail industry; and most suited strategies to survive and thrive in this new digital-first environment.

Our research identified four megatrends that can help inform strategic plans:

(1) Scale through consolidation and partnerships -

The largest 20 retailers in the UK accounted for 58% of the total retail market in 2020, significantly ahead of other European markets…

(2) Repurposing stores and social spaces…

(3) Supply chains and logistics…

(4) Direct-to-Consumer…

Take out a free 30 day membership trial to read the full report >

IMRG Capgemini e-Retail Sales Index

Source: IMRG

Source: IMRG