UK Online Retail Sales Report summary

March 2022

Period covered: Period covered: 30 January – 26 February 2022

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Online retail sales growth fell by 00% YoY in February (value and non-seasonally adjusted), against record high growth a year ago (+00%).

Strong comparisons a year ago

Last year’s performance was supported by the national lockdown, which covered the entire February 2021 trading period.

Following last year’s successful vaccine rollout, confidence amongst consumers grew, with increased spending power from cancelled holidays, less socialising and commuting supporting demand.

With non-essential retail shops closed, consumers were able to draw on previously learnt behaviours, switching to lockdown buying habits. The online penetration rate rose to a near-record high rate of 00%.

Against these tough comparisons online penetration slowed to 00% this February, the weakest since August 2021.

Transference of spend

The ending of Covid-19 restrictions was a catalyst for many consumers to return to physical locations. Footfall rose 00% MoM, the sharpest monthly uplift since June 2021 (Springboard). More socialising and a return to offices were supportive factors.

Online Food suffered as many consumers returned to physical shopping. Visits to stores increased by 00% in February while 00 fewer consumers were said to have shopped online for groceries (Kantar, four weeks to 20 February).

Against the backdrop of rising inflation and squeezed incomes, the growth of store visits could indicate in-store shopping preferences for consumers looking to gain greater control of their spending, searching for deals and end-of-aisle discounts to stretch their budgets.

As customer missions become more cost-focused they will increasingly shop around, trade down, switch brands and channels.

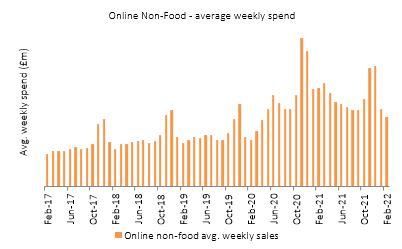

Within Non-Food, declines were seen across all categories against highs a year ago. Household Goods (-00%) was the weakest performing against last year’s record high (+00%). Anecdotally, demand for home-related items continues to be supported by consumers’ desires to improve their living environments, a lockdown adopted trend.

Take out a FREE 30 day membership trial to read the full report.

Online Non-Food spend falls

Source: ONS

Source: ONS