UK Online Retail Sales Report summary

August 2021

Period covered: Period covered: 4 - 31 July 2021

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Online retail sales fell by 00% year-on-year (value and non-seasonally adjusted) in July, against a 55.6% rise a year ago, improving on last month’s record low.

Consumers had reason to celebrate at the start of July, with confidence boosted by England’s strong performance at Euro 2020 and the government confirming (on 12 July) that the majority of Covid-19 restrictions would be lifted on 19 July. As a result, spending was diverted to other areas of the economy.

‘Freedom Day’ acted as a catalyst for consumers to visit restaurants according to OpenTable. The number of diners rose by 3 percentage points on the previous week (7-day average), up 119% on the equivalent period in 2019.

However, as the month progressed, a combination of consumer caution and frustration set in. The NHS Covid-19 app notified some 600,000 people to self isolate, driven by a sharp rise in Covid-19 case numbers in the week to 14 July. Case numbers rose from c.25,000 at the start of the month to over 50,000 by 16 July.

More time spent at home benefited the online channel, supported by unsettled weather. Weekly data from IMRG suggested that online sales growth fell by -5% in the final week of July, compared with a 14% decline at the beginning of the month.

Resultantly, the online penetration rate improved for the first time since the start of the year, with online sales accounting for 00% of overall retail sales in July, up from 26.2% in June.

In terms of category performance, just two managed to record a rise in sales growth; Clothing & Footwear and Household Goods.

Clothing & Footwear was boosted by an increase in social gatherings since the relaxation of Covid-19 restrictions, with events such as weddings allowed to take place with no limits on capacity for the first time since the onset of the pandemic.

After a brief spell in negative territory last month, the Household Goods category bounced back, supported by feverish housing market activity.

Data from HMRC showed that the number of houses sold reached a record high in June (198,240), as the end to the stamp duty holiday approached. In July, somewhat expectedly, the number fell back dramatically, down by 63% on the previous month to 73,700. Despite this fall, low mortgage rates should support house purchases in the months to come, benefitting home-related categories.

This month we take a deeper look at the impact of Covid-19 on profitability in the UK retail market.

Our research highlights five phases that will result in an erosion of profitability as a direct consequence of the pandemic:

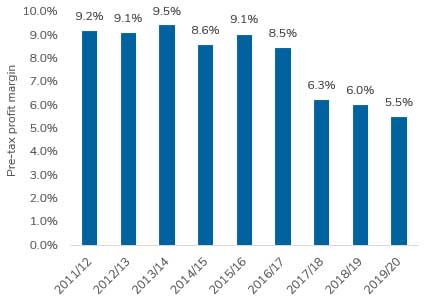

(1) Profit margins already under pressure - Even before Covid-19, UK retail market profitability was already under pressure. Over the last five years, pre-tax profit margins have almost halved from 9.1% (2015/16) to 5.5% (2019/20).

(2) Profit margins fall as penetration rates rise - …

Take out a free 30 day membership trial to read the full report >

Pre-tax profit margins have almost halved in five years

Source: Retail Economics, company reports

Source: Retail Economics, company reports