UK Homewares Sector Report summary

May 2021

Period covered: Period covered: 04 April – 01 May 2021

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Subscribe to access this data or take out a free 30 day subscription trial now.

Homewares sales increased 00% year-on-year in April, according to Retail Economics. However, this figure is artificially inflated by the steep decline seen a year earlier.

On a two-year, pre-pandemic basis, homewares sales rose 00% in April, boosted by the reopening of “non-essential” retail stores.

Footfall remains significantly below pre-crisis levels. Footfall across all retail destinations in April was still 32.7%, down on the same month in 2019, according to Springboard.

For homewares, the reopening of stores inevitably provided a sales boost, with pent-up demand most evident for textiles (e.g. curtains, bedding). Textiles rely more on physical touchpoints in the customer journey than smaller-ticket homeware items (e.g. kitchenware, home accessories) that consumers are more able and willing to buy online.

Nevertheless, there has still been a permanent shift to online. Our research found that a 00 of consumers expect to shop more online for homeware products, rather than in-store, even after the impact of the pandemic recedes.

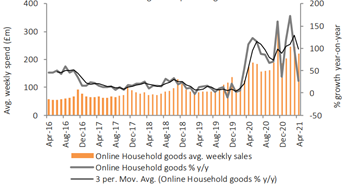

Online Household Goods sales grew by 26.6% year-on-year in April, a marked slowdown on the 129.3% average growth recorded over the previous three months during lockdown (Jan-Mar 2021).

Average weekly online spend on household goods was £220m in April, up from £174m a year earlier

Retail Economics forecasts Homewares to grow by 00% year-on-year in 2021. This would mark a swift recovery for the sector as it returns to 2019’s pre-pandemic sales levels.

IKEA is said to be in advanced talks to take over the former Topshop flagship store on London’s Oxford Street, as part of its plan to open more smaller-format outlets in city centres. It launched its long anticipated ‘buy back’ initiative, allowing customers to sell unwanted furniture back to the retailer in return for an Ikea voucher.

Take out a free 30 day membership trial to read the full report >

Online Household goods - spend vs. growth

Source: ONS, Reatail Economics analysis

Source: ONS, Reatail Economics analysis