UK Homewares Sector Report summary

March 2022

Period covered: Period covered: 30 January – 26 February 2022

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Homewares Sales

Homewares sales softened to a 00% YoY rise in February, against a soft 00% comparative last year according to Retail Economics.

The continued easing of Covid restrictions in recent months has brought with it opportunities to spend freely outside of retail, which has dented the performance of previously strong performing home-related categories.

As Covid concerns fade, a spring wave of house activity is expected amid £00bn of excess savings households have accumulated since the pandemic. A survey among estate agents by housing trade body RICS shows buyer enquiries for February continued to pick up, with a net balance of 00% of agents noting a rise, up from 00% in December.

But as the stamp duty holiday demonstrated, the performance and churn of the residential housing market is being slowed down by onerous taxation related to home moves, which is impacting the number of homes available for sale.

While this could lead to an ‘improve not move’ mentality as house prices continued to rise, Homewares sales are being hampered by ongoing product supply chain issues, leading to limited availability and delays among certain lines.

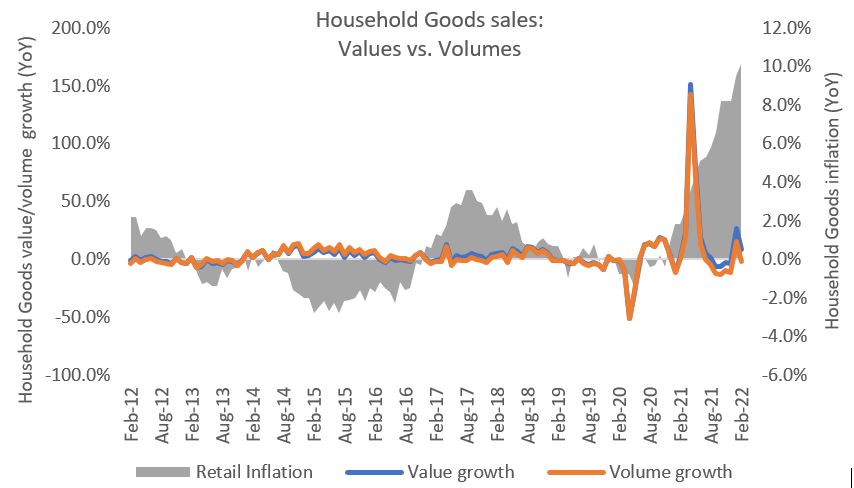

Values detach from volumes

Shortages, delays and cost base inflation saw key Homewares input prices such as textiles step up by 00% YoY in February.

Retailers are having to jack up prices to maintain margins. Bellwether retailer Next expects its Homeware and Furniture prices in the second half of the year to increase by an eyewatering 00%.

Such levels of inflation is creating a wedge between the value and volume of retail sales. Retail inflation among Household Goods measured by ONS’s price deflator hit 00% YoY in February – the highest since records began in 1989. With inflation at record highs, the underlying volume of Homewares sales declined in February.

Impact on discretionary spending

Retail Economics estimates that the least affluent will see discretionary income (after staple and work-related expenses) fall by 00% in 2022.

With further headwinds impacting discretionary budgets baked in, including April’s National Insurance Contribution rise, consumers are adopting savvy spending behaviour.

New market entrants

A greater focus on value and price could play well into the hands of new entrants. Fashion heavyweights such as Boohoo, H&M and Zara have accelerated their presence in the Homewares market, as they look to carry their young upwardly mobile customer bases through their life stages beyond apparel.

The ranges among such players are typically price focused but trend-driven, appealing to cash-strapped consumers that are looking for small and fashionable indulgences.

Take out a FREE 30 day membership trial to read the full report.

Values vs. volumes

Source: ONS, Retail Economics analysis

Source: ONS, Retail Economics analysis