UK Health & Beauty Sector Report summary

January 2022

Period covered: Period covered: 28 November – 01 January 2022

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Health & Beauty sales grew by a resilient 6.8% YoY in December, with sales up 00% on pre-pandemic levels.

Despite tighter restrictions being introduced in the month, including a return to work from home guidance, beauty gifting drove sales in December.

Strength of gifting

December’s performance follows resilient growth in November, when many pulled Christmas spending forward, having previously anticipated availability and delivery issues amid shortages.

Analysing spending over the two-month period across November and December provides a better picture of underlying demand for Christmas spending, which saw Health & Beauty register a robust 00% uplift in sales, against a 00% decline last year.

The strength of fragrance and beauty gifts were key drivers in December, including bath and body products. This came despite pressure from cancelled social events, following government’s ‘Plan B’ restrictions which saw the return of work from home guidance.

The shift in government’s position concerning Omicron saw households make voluntary behavioural changes and revert to previous lockdown-style behaviours.

Softening backdrop

Going into 2022, consumers will face many cost pressures that will squeeze disposable incomes.

From the second quarter, households are facing a hit on finances from hospitality VAT returning to 20% (from 12.5%), an increase in NIC of 1.25 percentage points, and the prospect of a 50% uplift in the energy price cap.

The impact of rising NIC and energy bills alone will see the average household suffer a reduction in income of £1,100 in 2022, according to The Resolution Foundation – £600 from NIC and £500 from higher energy bills.

This has hit intentions to spend. Some 00% of consumers intend to spend less on non-essential items over the next quarter.

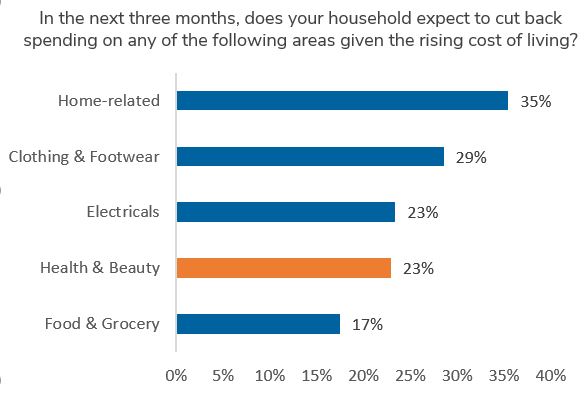

Households intend to cut back on discretionary purchases going forward, including over a fifth (23%) of consumers expecting to curb Health & Beauty spending.

Take out a FREE 30 day membership trial to read the full report.

In the next three months, does your household expect to cut back spending on any of the following areas given the rising cost of living?

Source: Retail Economics consumer panel – December 2021

Source: Retail Economics consumer panel – December 2021