UK Furniture & Flooring Sector Report summary

September 2021

Period covered: Period covered: 1 – 28 August 2021

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Furniture & Flooring sales continue to grow but at a slower pace than initially seen following the reopening of stores. Sales rose 00% YoY in August, and were up 11.2% on 2019’s pre-pandemic levels.

August marked the first full month that Covid restrictions were lifted this year, giving increased opportunity to spend in hospitality and leisure venues – dampening retail sales.

Since the start of the year, there have been over 1,000,000 residential property transactions in the UK (Jan-Aug), 42% higher than the 10-year average for this period

UK consumers who are buying a house this year are expecting to invest an average of £5270 on purchases for their new home, according to research by eBay.

The recent wave in home moving presents big opportunities for retailers selling household goods, particularly heading into the Autumn when consumers spend more time indoors.

Retailers face challenges in maintaining stock levels due to supply chain bottlenecks from labour shortages, manufacturing backlogs and shipping delays.

Ikea reported that all 22 of its UK and Ireland stores were having supply problems with 10% of its stock, or around 1,000 product lines.

Supply constraints have come at a time when businesses are grappling heightened demand as normality returns. This has reduced the elasticity of supply, meaning retailers are less able to react quickly to changes in market conditions, requiring strong forward planning at a time when uncertainty remains high.

Retail Economics forecasts furniture and flooring sales to rebound over 2021, growing by 00% YoY, to reach £14.1bn. This follows a 00% decline in 2020.

Furniture and flooring sales suffered from non-essential store closures during the pandemic. Big-ticket items such as furniture clearly rely more on physical interactions than other products. Shoppers are more hesitant to buy online without the sensory experience that shops and good customer service offers.

Take out a free 30 day membership trial to read the full report >

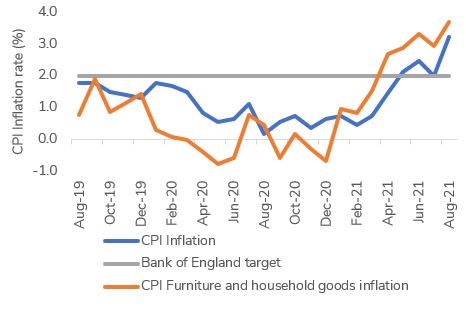

Furniture prices rising sharply

Source: Bank of England, Kantar, Retail Economics analysis

Source: Bank of England, Kantar, Retail Economics analysis