UK Furniture & Flooring Sector Report summary

October 2021

Period covered: Period covered: 29 August – 2 October 2021

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Furniture & Flooring sales fell by 0.00% YoY in September, according to the Retail Economics Retail Sales Index. This was the first YoY decline for the sector since February when the UK was in lockdown. Sales were still up 0.00% on 2019’s pre-pandemic levels.

Retail sales run out of fuel

Total retail sales rose by 0.00% YoY in September, the weakest performance since February, according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted).

It was a positive start to September with a bank holiday weekend, warm weather, kids returning to school, and the lifting of travel restrictions abroad, all fuelling hopes of a return to normality.

But for consumers, any sense of a return to normality didn’t last long. Global supply chain bottlenecks coupled with labour shortages (e.g. farmers, warehouse workers, lorry drivers) led to delivery delays and warnings from retailers over the availability of goods.

Panic buying at fuel pumps in the final weeks of September brought into sharp focus the impact that labour shortages and supply chain challenges can have for consumers, who immediately responded by cutting back on shopping trips that require a vehicle.

Furniture & Flooring slowdown

The decline in Furniture & Flooring sales in September (0.00%) was driven by:

1) Tough comparisons – Furniture & Flooring sales continue to lose momentum due to strong comparisons from a year earlier when sales enjoyed strong growth (0.00% YoY).

2) Focus on social - With restrictions now eased, consumer spending has pivoted towards social activities outside of the home. In addition, more people are returning to offices, further shifting consumer attention away from home furnishings.

3) Fuel crisis - Shoppers reluctance to drive to retail locations to view and collect goods had an acute impact on sales which rely heavily on touch-and-feel for conversion.

4) Supply struggles – Manufacturing delays, shipping backlogs, and labour shortages are having a negative effect on the availability of stock in stores.

Cost pressures for retailers and consumers

With Black Friday and the peak trading season upon us, supply chain disruption is causing a costly ‘headache’ for retailers as they scramble to meet demand.

The Baltic Dry Index (indicative of shipping costs) is up 0.00% YoY (as of 20 October), due to congestion in Chinese ports and surging demand for energy imports.

The continuous increase in the prices of commodities such as random-length lumber has increased the production cost of sofas, beds, tables, and wood floorings.

Ikea has warned that stock shortages are likely to last for another year as they foresee problems in the availability of raw materials persisting until August 2022.

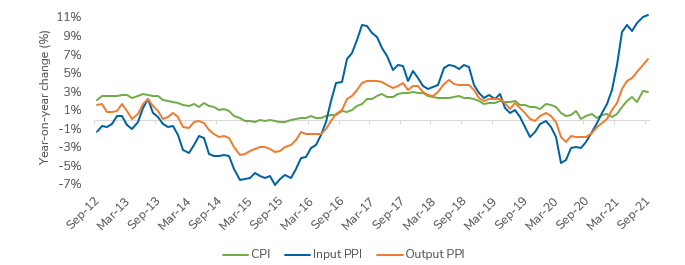

Supply chain issues are placing upward pressure on retailers’ costs. Fig 1 shows the changes in the prices of goods bought and sold by UK manufacturers, including price indices of materials and fuels purchased (Input PPI), and factory gate prices (Output PPI).

Housing market offers upside

September marked the end of the stamp duty tax holiday in England, with an estimated 0.00 residential transactions completed during the month – almost 0.00% higher than the long-run average for this time of year.

The recent wave in home moving presents big opportunities for retailers selling household goods, particularly over Autumn/Winter when consumers spend more time indoors.

While a slight cooling in the housing market is now likely, demand is by no means expected to drop off a cliff

0.00% of UK households remain eager to move in the next 18 months according to Zoo.

Take out a FREE 30 day membership trial to read the full report.

Inflationary pressure is building as PPI hits decade high

Source: ONS

Source: ONS