UK Furniture & Flooring Sector Report summary

December 2020

Period covered: Period covered: 01 November – 28 November 2020

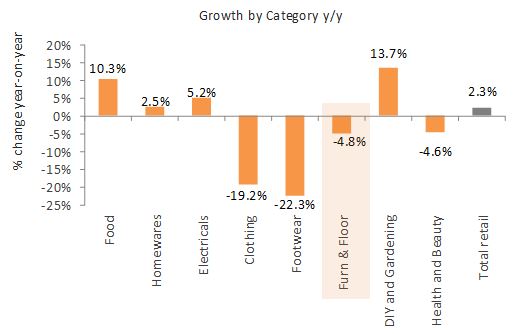

Retail sales jumped 2.3% in November, year-on-year, according to Retail Economics. Total online retail sales rocketed 79.6% year-on-year in November, value and non-seasonally adjusted, ONS. Shop price inflation dipped by 1.2% in November, excluding fuel, according to ONS. Furniture & Flooring retail sales fell by 4.8% in November year-on-year, value and non-seasonally adjusted, according to Retail Economics. Average weekly sales for Furniture & Flooring were £269m in November, according to Retail Economics.

Furniture & Flooring –Retail Economics Index: November 2020

Furniture & Flooring sales growth fell by 4.8% year-on-year in November, against a 3.3% decline a year ago, following five consecutive months of growth. Resultantly, sales growth underperformed the three-month average of 5.0%. As coronavirus cases rose, restrictions tightened across the country, culminating in the announcement of a second national lockdown (on 31st October) as we entered the… read more

Redistribution of spend

The four-week national lockdown began on 5 November, leading to the closure of non-essential retailers and hospitality sector. In the first few days of trading at least, consumers hit physical locations while able to. Springboard data suggests that shopper numbers rose by 19% week-on-week before shops shut. Notably, footfall growth in Retail Parks, where furniture retailers are typically housed, was higher than 2019 levels.

Increased demand in December

Encouragingly, more than one in ten consumers (11%) delayed spending on home related products as a direct result of the second lockdown which is likely to create pent up demand in December. Over a third (37%) of consumers suggested they spent less than planned during November, a further indication of pend-up demand in the pipeline. The big uncertainty heading into the final month of 2020 (and beyond) is the magnitude of impact from tougher restrictions imposed.

Macro Factors – Housing Market Activity

Mortgage approvals accelerated in October to 97,532 up from 92,091 in the previous month and significantly ahead of the previous six-month average of 51,810. This was the sharpest rise in mortgage approvals since September 2007. Mortgage approvals are currently 33% higher than in February 2020 and up by 51% compared to the same month a year ago. The number of re-mortgaging approvals rose marginally on the previous month, totalling 32,851 in October up from 32,773 in September. This was lower the previous six-month average of 33,980.

Macro Factors – Credit and Borrowing

Annual growth in secured lending was broadly unchanged in October, rising by 2.7% year-on-year. The monthly change in the additional amount households borrowed totalled £4.3bn, lower than the £4.9bn in the previous month but remaining above the previous six-month average of £2.4bn. Households borrowed an additional £3.7bn of loans in October slowing on the £4.2bn borrowed in the month before and above the previous sixmonth average of £0.4bn.

Macro Factors – Household Spending

Consumer spending on furnishings and household equipment amounted to £11,174m in Q2 2020, registering a 24.0% fall on the previous quarter. This was the biggest quarterly decline in the last decade. On an annual basis, spending also fell by a similar rate, down 26.3%. This was the sharpest decline on this basis since Q4 2012. Furniture & Furnishings, Carpets and other Flooring contracted by 43.1% in Q2 2020 and fell by 47.5% on an annual basis. Expenditures on Household Appliances fell by 19.1% in… read more

Macro Factors – Consumers

Household consumption rose by 18.3% in Q3 2020 on the previous quarter, totalling £294,468m. This follows a 23.6% contraction in the previous quarter. Household consumption remains 12.4% below its Q4 2019 level. GfK’s Consumer Confidence fell by two points to -33 in November, 19 points lower than in the same month a year ago and the lowest reading since May. Three measures within the index decreased compared to the previous month.

Macro Factors –Ipsos Retail Performance

As a result of the government imposing new lockdown restrictions and the closure of non-essential stores in November, IPSOS did not track shopper numbers in November. However, IPSOS forecast overall UK footfall to fall by 55.7% in December 2020 compared to the same month a year ago. The steepest declines in footfall are anticipated to be in Scotland & N Ireland (-69.5%) and Northern England (-61.4%).

Macro Factors –Labour Market

The latest ONS labour market data shows some recovery in hours worked, despite redundancies hitting a record high as hospitality and physical retail remains under intense pressure from Covid-19 restrictions. The number of paid employees is down some 819,000 in November compared with March 2020 according to flash estimates using PAYE data. However, the largest falls were seen at the start of the coronavirus outbreak. Hospitality has been the hardest hit, with 297,000 fewer payroll workers since the start of the pandemic, followed by… read more

Macro Factors –Earnings

For October in nominal terms (unadjusted for price inflation): Average regular pay (excluding bonuses) for employees in Great Britain was £527 per week before tax and other deductions from pay – up from £509 per week a year earlier. Average total pay (including bonuses) for employees in Great Britain was £560 per week before tax and other deductions from pay.

Macro Factors –Costs, Prices and Margins

Sterling’s trade weighted index rose in November, up 1.1% on the previous month. The index has been impacted by the ongoing uncertainty surrounding Brexit negotiations with a deal between the UK and EU not yet reached. In terms of exchange rates, the £/$ rate is currently around 1.34, while £/€ dipped to around 1.10. Both commodity indexes we track rose in December. Indeed, the Thomson Reuters CRB Index fell by 10.9% year-on-year from -15.6% in November.

Factory gate inflation rose to -0.8% in November, up from -1.4% in the previous month. On a month-on-month basis, output inflation rose by 0.2%, the sharpest monthly increase since July 2020. Five product groups provided a negative contribution to the annual output inflation rate in November … read more

Furniture sales impacted by second lockdown

Source: Retail Economics

Source: Retail Economics