UK Food & Grocery Sector Report summary

November 2021

Period covered: Period covered: 3 October – 30 October 2021

1 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Food sales improved in October, rising by 0.00% YoY against a 0.00% rise a year earlier, according to the Retail Economics Retail Sales Index. Against 2019’s pre-pandemic levels, Food sales rose by 0.00%.

After the disruption of the petrol crisis at the end of September, visits to stores picked up in October, with households making 0.00 store visits on average, from 0.00 last month.

Online Food sales growth fell back (-2.9% YoY) against strong comparisons a year ago when rising anxiety amongst consumers resulted in a surge in online shopping. Smaller online basket sizes are also weighing on performance with consumers no longer needing to do large shops.

However, sales growth remains significantly ahead of pre-pandemic times (+0.00% Y-2Y), with a fifth of households consistently ordering groceries online each month.

In terms of category performance Christmas related items also sold well, no doubt driven by uncertainty surrounding the ongoing supply chain disruptions with consumers wanting to make sure they had the Christmas essentials in case of any shortages closer to the day.

In fact, our own analysis suggests access to retail products has worsened with almost half (49%) of consumers reporting they had difficulty accessing products as a result of ongoing supply chain issues. This is up from just under a third (31%) in September.

Bad weather events in key growing regions, rising commodity prices, strong demand and supply chain disruptions brought about by the easing of covid-19 restrictions have caused global food prices to surge.

In addition, while shipping costs have fallen back sharply in the last few weeks, (from a 10-year high), these elevated costs are still working their way through to consumers.

The cost manufacturers are facing (input producer price inflation) rose to a 0.00 high in October, while the inflation retailers are facing (output price inflation) rose to a 0.00 high.

Take out a free 30 day membership trial to read the full report >

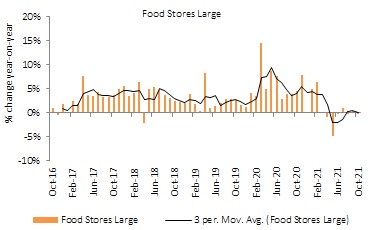

Large food stores see sales growth dip

Source: ONS

Source: ONS