UK Electricals Sector Report summary

October 2020

Period covered: Period covered: 30 August – 3 October 2020

Note: Reporting periods are either one or two months behind the current month as standard reporting practice.

Retail sales rose by 5.0% in September, year-on-year, according to Retail Economics. Total online retail sales increased by 52.6% in September, value and non-seasonally adjusted, according to ONS. Shop price inflation fell by 0.5% in September, excluding fuel, according to ONS. Electricals retail sales rose by 5.6% in September, year-on-year, value and non-seasonally adjusted, according to Retail Economics. Average weekly sales for Electricals were £345m in September, according to Retail Economics.

Electricals –Retail Economics Index: September 2020

Electricals sales rose by 5.6% year-on-year in September, against a 1.2% rise a year ago – falling back on the previous month. Despite the slowdown in annual sales growth, it aligned to the three-month rolling average while significantly outperforming the 12-month average of 1.5%.

Macro Factors –Consumers

Consumer spending totalled £248,995m in the second quarter of 2020 resulting in a quarterly contraction of 23.6%. This is the largest contraction on record. Similarly, spending on an annual basis fell by 26.2%. GfK’s Consumer Confidence measure rose in September, up by two points to -25, some 13 points lower than the same month a year ago. Within the index, three measures increased, one decreased and one remained the same.

Macro Factors –Ipsos Retail Performance

Latest figures from Ipsos Retail Performance showed that footfall fell 39.6% in September year-on-year (this measures footfall in over 4,000 non-food stores UK-wide). This was an improvement on the previous month and the best result since February. On a month-on-month basis, footfall fell by 1.1% across the UK. The weakest performing UK area was Scotland & Northern Ireland which registered a 3.8% drop in footfall.

Macro Factors –Labour Market

The latest ONS labour market data shows little change in the number of PAYE employees on the previous month, while the unemployment rate and level of redundancies increased. (Note: the ONS made methodology changes this month accounting for coronavirus impacts). The number of paid employees was down by some 673,000 in September compared with March 2020 according to flash estimates using PAYE data.

Macro Factors –Costs, Prices and Margins

Sterling’s trade weighted index slowed in September as fears over Brexit and restrictions due to rising cases of Covid -19 weighing on market sentiment. In terms of exchange rates, the £/$ rate is currently around 1.30, while £/€ remained around to 1.10. Both commodity indexes we track reported a slight improvement on the previous month in October while remaining negative on a year earlier.

Factory gate inflation remained at -0.9% in September, unchanged for the fourth consecutive month, its sixth month in negative territory. On a month -on -month basis, output inflation fell by 0.1%… read more

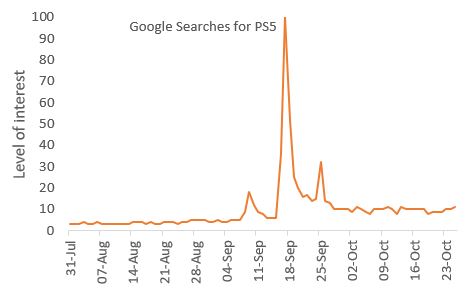

Online channel boosted by pre-sales of hotly anticipated game consoles

Source: Google

Source: Google