UK Electricals Sector Report summary

January 2021

Period covered: Period covered: 29 November – 02 January 2021

Retail sales rose by 0.8% year-on-year in December, according to Retail Economics. Total online retail sales increased by 45.8% in December, value and non-seasonally adjusted, according to ONS. Shop price inflation fell by 0.6% in December, excluding fuel, according to ONS. Electricals retail sales rose by 2.7% year-on-year in December, according to Retail Economics (value and non-seasonally adjusted). Average weekly sales for Electricals were £574m in December, according to Retail Economics.

Electricals –Retail Economics Index: December 2020

Electricals sales rose by 2.7% year-on-year in December. While still positive, this is the weakest growth figure since May, during the first lockdown, followed by a strong run over the second half of 2020 (6-month average: 5.7%). Electrical sales were up 3.3% on a full-year basis, totalling £21.7bn in 2020. The shift to home working, which boosted demand for laptops and office equipment, coupled with existing high online penetration rates, helped shield the sector from the negative impacts of… read more

Electricals near the top of wish lists

The newly released PS5 and Xbox Series X were in high demand over Christmas, with accompanying games and audio equipment also performing well as gifts. Sony reportedly sold a record 3.4 million PS5 units in the first four weeks, with most UK retailers quickly selling out of stock. The consoles also spurred demand for larger 4K TVs. As people spend more time at home, many consumers are choosing to spend additional savings on upgrading in-home entertainment. We estimate that average households will… read more

The Power of Online

Online Electricals sales rose by 116% year-on-year in December, according to IMRG. Our research showed that 70% of consumers shopped more online in December than expected because of coronavirus restrictions. Two thirds of consumers said that they ‘consciously’ avoided physical shopping destinations over Christmas because of fears over the virus… read more

2021 Outlook

The January sales is a key trading period for big-ticket household goods, but a return to lockdown will see spending revert to online channels once again. Following almost a year of disruption, both retailers and consumers are now better positioned to adapt to non-essential store closures. Demand for Electricals should prove more resilient than other non-food sectors, as people spend more time at home for work and… read more

Macro Factors – Consumers

Household consumption rose by 19.5% in the third quarter of 2020. The main drivers were increased spending in restaurants and hotels, and transport. Household consumption remains 9.8% below its Q4 2019 level. GfK’s Consumer Confidence measure improved by seven points to -26 in December, this is 11 points lower than a year ago. All five measures within the index increased compared to the previous… read more

Macro Factors – Ipsos Retail Performance

Footfall fell by 53.7% in December 2020 year-on-year, according to latest figures from Ipsos Retail Performance (which measures footfall in over 4,000 non-food stores across the country). The steepest declines in footfall for the month of December were in London & South East (-61.9%) followed by Scotland & N Ireland (59.2%) and The Midlands (-52.1%). Similarly, footfall fell in SW England & Wales (-50.9%) and Northern England (-44.8%) … read more

Macro Factors – Labour Market

The latest ONS labour market data shows a significant increase in unemployment rate while employment rate continues to fall. Though redundancy levels reached record highs, total hours worked increased from the low levels in the previous quarter. The number of paid employees fell by 2.7%, some 828,000 employees in December compared with February 2020 according to flash estimates using PAYE data – around 52,000 higher than in… read more

Macro Factors – Earnings

For November in nominal terms (unadjusted for price inflation): Average regular pay (excluding bonuses) for employees in Great Britain was £531 per week before tax and other deductions from pay – up from £510 per week a year earlier. Average total pay (including bonuses) for employees in Great Britain was £562 per week before tax and other deductions from pay – up from £543 per week a… read more

Macro Factors – Costs, Prices and Margins

Sterling’s trade weighted index dipped marginally in December, down 0.3% on the previous month as Brexit uncertainty and rising coronavirus cases impacted the index. In terms of exchange rates, the £/$ rate is currently around 1.36, while £/€ rose to around 1.12. Both commodity indexes we track appreciated in January. Indeed, the Thomson Reuters CRB Index fell by 3.9% year -on -year from -11.9% in December, compared to a 17.6% annual fall for the GSCI Commodities benchmark. The rise was driven by expectations of strong international demand during 2021, particularly from… read more

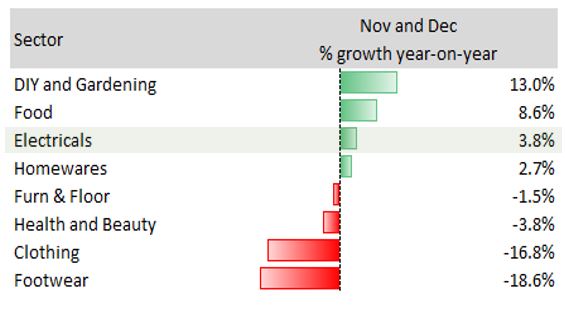

Electricals a bright spot in Non-Food Retail

Source: Retail Economics

Source: Retail Economics