UK Electricals Sector Report summary

December 2020

Period covered: Period covered: 01 Nov 2020 – 28 Nov 2020

Retail sales rose by 2.3% in November, year-on-year, according to Retail Economics. Total online retail sales rocketed by 79.6% in November, value and non-seasonally adjusted, according to ONS. Shop price inflation fell by 1.2% in November, excluding fuel, according to ONS. Electricals retail sales rose by 5.2% in November, year-on-year, value and non-seasonally adjusted, according to Retail Economics. Average weekly sales for Electricals were £427m in November, according to Retail Economics.

Electricals –Retail Economics Index: November 2020

Electricals sales rose by 5.2% year-on-year in November, against a weak comparison a year ago when sales growth fell by 13.4%. Notably, November’s trading period was distorted by the extra week in 2020 (53 not 52). Hence, Black Friday is included in November’s figures this year instead of December in 2019. The slight slowdown in sales growth in November against the previous month resulted in growth underperforming the three-month average of 5.7%.

National lockdown drives sales growth online

As we entered the November trading period (1 – 28 November), the government had just announced (31 October) that England would enter a second lockdown on 5th November, lasting four-weeks, leading to the closure of non-essential retail stores and the hospitality sector.

Macro Factors – Consumers

Household consumption rose by 18.3% in Q3 2020 on the previous quarter, totalling £294,468m. This follows a 23.6% contraction in the previous quarter. Household consumption remains 12.4% below its Q4 2019 level. GfK’s Consumer Confidence dipped by six points to -31 in October -17 points lower than in the same month a year ago and the lowest reading since May.

Macro Factors –Ipsos Retail Performance

As a result of the government imposing new lockdown restrictions and the closure of non-essential stores in November, IPSOS did not track shopper numbers in November. However, IPSOS forecast overall UK footfall to fall by 55.7% in December 2020 compared to the same month a year ago. The steepest declines in footfall are anticipated to be in Scotland & N Ireland (-69.5%) and Northern England (-61.4%).

Macro Factors –Labour Market

The latest ONS labour market data shows some recovery in hours worked, despite redundancies hitting a record high as hospitality and physical retail remains under intense pressure from Covid-19 restrictions. The number of paid employees is down some 819,000 in November compared with March 2020 according to flash estimates using PAYE data. However, the largest falls were seen at the start of the coronavirus outbreak. Hospitality has been the hardest hit, with 297,000 fewer payroll workers since the start of the pandemic, followed by… read more

Macro Factors –Earnings

For October in nominal terms (unadjusted for price inflation): Average regular pay (excluding bonuses) for employees in Great Britain was £527 per week before tax and other deductions from pay – up from £509 per week a year earlier. Average total pay (including bonuses) for employees in Great Britain was £560 per week before tax and other deductions from pay.

Macro Factors –Costs, Prices and Margins

Sterling’s trade weighted index rose in November, up 1.1% on the previous month. The index has been impacted by the ongoing uncertainty surrounding Brexit negotiations with a deal between the UK and EU not yet reached. In terms of exchange rates, the £/$ rate is currently around 1.34, while £/€ dipped to around 1.10. Both commodity indexes we track rose in December. Indeed, the Thomson Reuters CRB Index fell by 10.9% year-on-year from -15.6% in November.

Factory gate inflation rose to -0.8% in November, up from -1.4% in the previous month. On a month-on-month basis, output inflation rose by 0.2%, the sharpest monthly increase since July 2020. Five product groups provided a negative contribution to the annual output inflation rate in November … read more

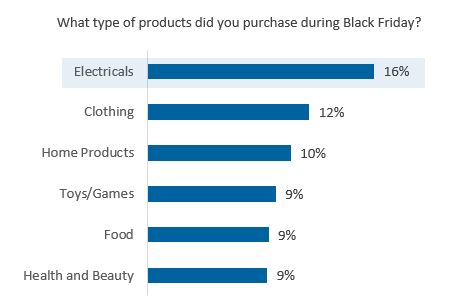

Black Friday supports category growth

Source: Retail Economics

Source: Retail Economics