UK DIY & Gardening Sector Report summary

May 2021

Period covered: Period covered: 04 April – 01 May 2021

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day trial now.

DIY & Gardening sales growth rose by 00% in April, year-on-year, against a 32.6% decline a year ago.

A year ago, sector sales nosedived as “essential” retailers (e.g. B&Q and Wickes) were forced to close while preparing for a Covid-secure trading environment. Against this backdrop, annual sales growth in April 2021 rocketed.

Data from Google search suggests keywords such as ‘garden heater’ (+358%), ‘gazebo’ (+104%), and ‘garden furniture’ (+77%) were well ahead of last years search activity – a key indicator of intention.

Warmer and drier weather was also a key driver with the Met Office reporting April was the sunniest on record and also the driest in 21 years.

Our research shows that 00% of consumers expect to shift more DIY and gardening spending online, rather than in physical stores, even after Covid restrictions relax.

Underlying demand is likely to remain strong into summer months, supported by consumers continued focus on their homes and strong housing market activity.

Encouragingly, our latest Shopper Sentiment Survey (April 2021) showed that spending intentions were strong, with a quarter (00%) of consumers indicating they would spend more on non-essential items over the next quarter.

DIY & Gardening has been one of the few non-food retail sectors to maintain in positive growth during the Covid-19 pandemic. The sector has benefited from people choosing to spend on home improvement projects during lockdown, while stores selling DIY and gardening items have remained open, owing to their essential status.

Retail Economics forecasts online DIY and gardening sales to decline by 00% in 2021, reflecting unfavourable year-on-year comparisons with 2020. Overall online penetration will remain above 2019’s pre-pandemic levels.

Kingfisher said total e-commerce sales for the quarter were up 63% in the period – or a huge 258% compared to 2019.

Take out a free 30 day membership trial to read the full report >

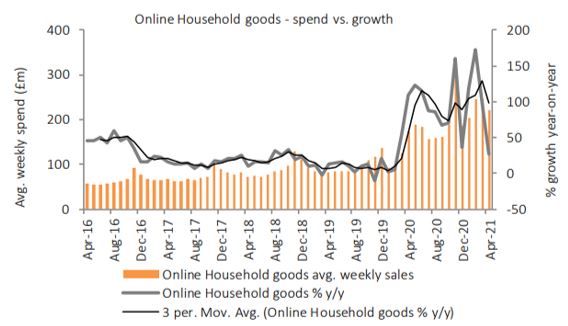

Online Household goods - spend vs. growth

Source: ONS, Retail Economics analysis

Source: ONS, Retail Economics analysis