UK DIY & Gardening Sector Report summary

March 2022

Period covered: Period covered: 30 January – 26 February 2022

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

DIY & Gardening Sales

DIY & Gardening sales rose 00% YoY in February, against robust 00% growth over the same period last year.

Three storms (Dudley, Eunice, Franklin) in February did not provide ideal conditions for gardening, but did bring distress DIY purchases as homeowners made emergency repairs to fencing and roofs.

Online Household Goods sales declined 00% YoY in February against tough comparisons a year ago when sales rose by 00% during lockdown.

Discretionary squeeze

The toll of rising inflation is already hurting consumer confidence. GfK’s consumer confidence measure plummeted seven points to 00 in February and dropped another five points to 00 in March – typically recession levels.

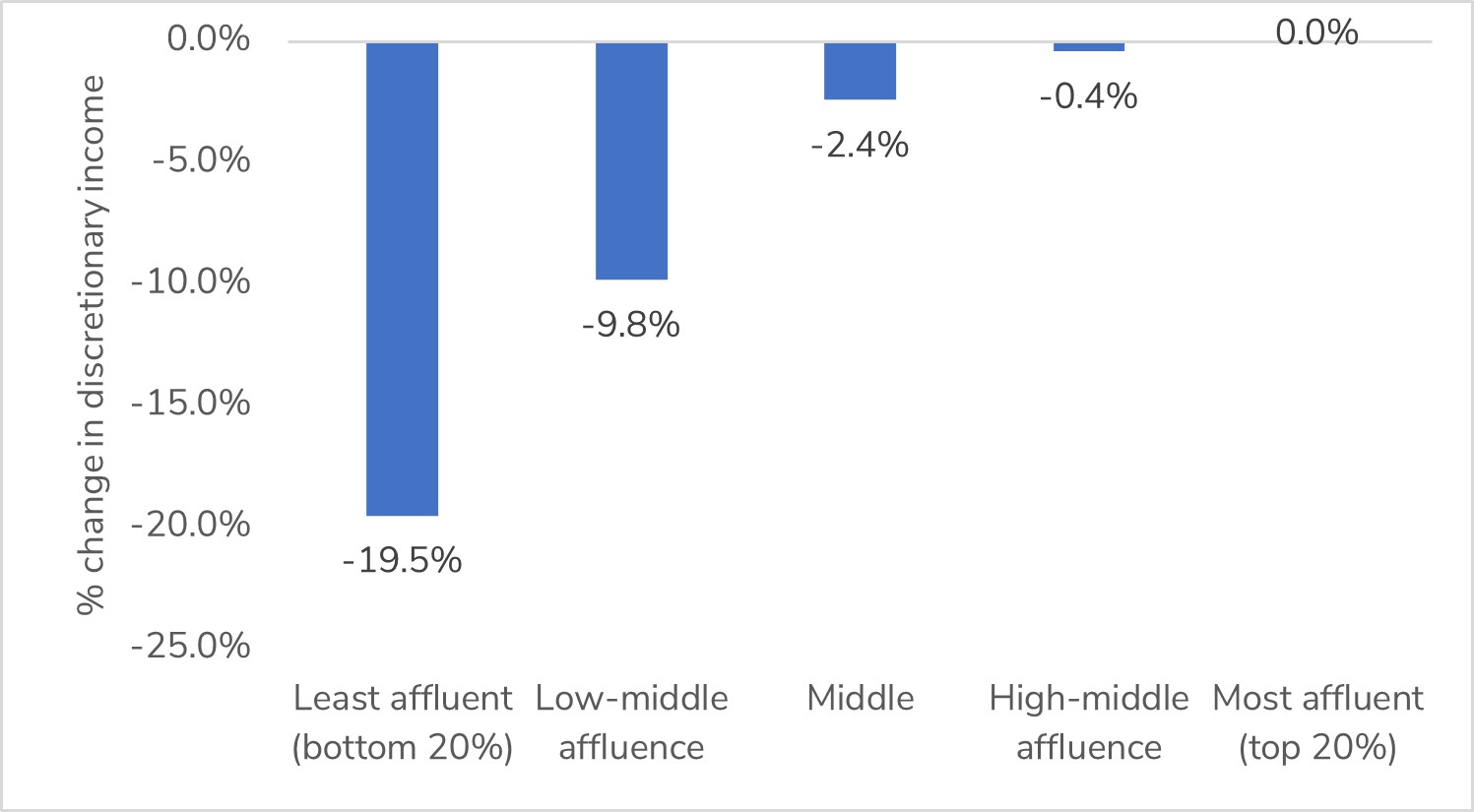

Rising living costs will hit low income households the hardest, as they spend a disproportionate amount of their income on staples (e.g. food, energy). Retail Economics estimates that the least affluent will see discretionary income (money left over after paying essentials) fall by 00% or £00 in 2022.

Overall, the cost of living crisis will see £00 of non-essential spending wiped out this year, which is equivalent to the size of the whole DIY & Gardening sector.

As high inflation constrains consumer budgets for big home improvement projects, a switch in focus to upcycling, repairs and smaller DIY tasks is expected.

Sector outlook

Consumer interest in home improvement is expected to wane as normality returns and spending diverts to other areas of the economy (e.g. holidays, leisure).

Factoring in a weaker housing market, supply issues and rising living costs, and the outlook for DIY & Gardening demand appears softer over the year ahead.

Retail Economics forecasts DIY & Gardening sales to fall 00% YoY, with total sales amounting to £00bn.

Take out a FREE 30 day membership trial to read the full report.

Least affluent households set to see a 19.5% decline in discretionary spending power in 2022

Source: Retail Economics

Source: Retail Economics