UK DIY & Gardening Sector Report summary

July 2022

Period covered: Period covered: 29 May – 02 July 2022

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

DIY & Gardening Sales

DIY & Gardening sales fell 00% YoY in June, against robust 00% growth a year earlier, according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted).

DIY & Gardening was the worst performing retail sector in June, with annual sales growth falling for the fourth consecutive month.

In what is the UK’s first summer in three years with no Covid restrictions, consumers are prioritising spending on holidays, leisure and social events over non-essential household-related expenditure.

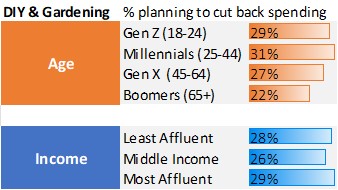

Consumers cutting back

Our research shows 00% of consumers plan to cut back on DIY & Gardening spending over the next twelve months. Although significant, this is lower than most non-food retail sectors.

We expect consumers to cut back on discretionary DIY spending, for example by putting major home renovations on hold, but distress purchases will prove more resilient.

In its recent trading update, Wickes said “We have seen some slowing of new orders in recent weeks, as customers are taking longer to commit to big ticket projects.”

Sector outlook

Despite cost of living pressures, lockdown highlighted the importance of domestic environments with many timid DIYers finding success and gaining confidence to continue improvements.

With so much time spent at home during the pandemic, consumers now want more from their property, including better spaces for work, socialising and relaxation.

Supply chain disruption is also easing for the sector. The improved availability of garden furniture and equipment will come as a relief to retailers, as consumers gear up for the summer season.

Typically, for DIY & Gardening, the outlook for the summer trading season largely rest on the weather.

Take out a FREE 30 day membership trial to read the full report.

Do you intend to cut back on DIY & Gardening spending this year due to the rising cost of living (i.e. spend less, delay or cancel)?

Source: Retail Economics, Grant Thornton. Sample: 2,000 UK households.

Source: Retail Economics, Grant Thornton. Sample: 2,000 UK households.