UK DIY & Gardening Sector Report summary

April 2022

Period covered: Period covered: 27 February – 02 April 2022

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

DIY & Gardening Sales

DIY & Gardening sales fell 00% YoY in March, against robust 00% growth over the same period last year, according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted).

March was the second sunniest on record and the driest in a decade, helping Gardening sales as consumers pruned their outdoor space ready for spring/summer.

Online Household Goods sales growth declined by 00% YoY in March, compared with growth of 101.1% a year ago.

Inflation impacts consumer mindsets

Rising living costs are now front of mind for consumers. April’s Retail Economics Shopper Sentiment Survey shows 00% of consumers are most concerned by rising inflation, up sharply from 00% in January.

The rising cost-of-living and ongoing war in Ukraine has shaken consumer confidence, which dropped to its second lowest level in 50 years in April – topped only by the global financial crisis in 2008 – as forward-looking indicators for personal finances and the general economy have fallen to historic lows (GfK).

Our own Retail Economics Shopper Sentiment Survey shows that over half of consumers plan to spend less on non-essential items over the next three months, the worst reading since 2017.

As high inflation constrains consumer budgets for major home renovations, a switch in focus to smaller DIY tasks is expected, particularly as many consumers will adopt an ‘improve not move’ mentality amid a harsher economic backdrop.

Sector outlook

Consumer interest in home improvement is expected to wane as normality returns and spending diverts to other areas of the economy (e.g. holidays, leisure).

Factoring in a weaker housing market, supply issues and rising living costs, and the outlook for DIY & Gardening demand appears softer over the year ahead.

Retail Economics forecasts DIY & Gardening sales to fall 00% YoY, with total sales amounting to £00.

Take out a FREE 30 day membership trial to read the full report.

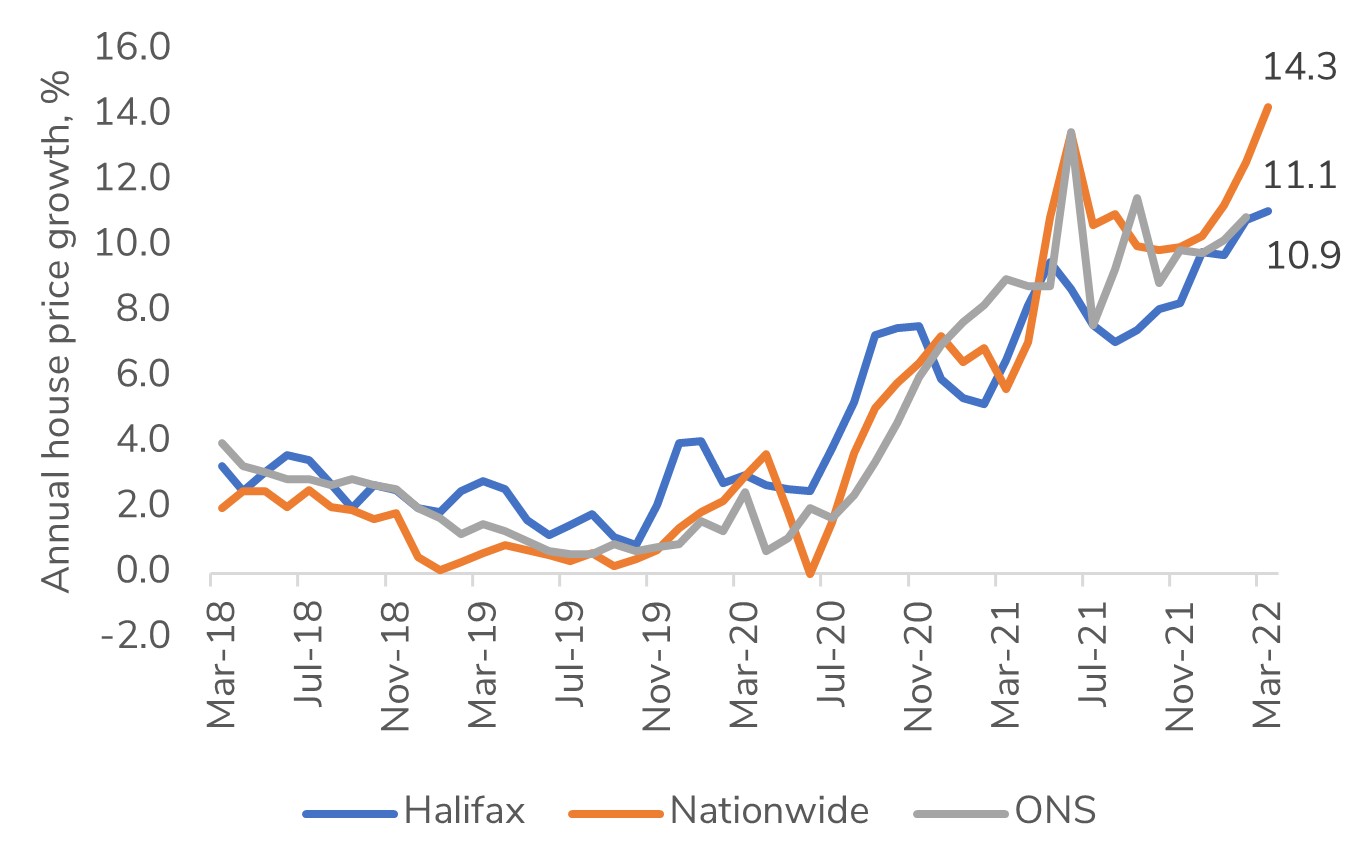

Housing market surprises as prices continue to see double-digit growth

Source: Halifax, Nationwide, ONS

Source: Halifax, Nationwide, ONS