UK Clothing & Footwear Sector Report summary

July 2021

Period covered: Period covered: 30 May – 03 July 2021

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Subscribe to access this data or take out a free 30 day subscription trial now.

Clothing sales rose above its pre-pandemic level two years earlier for the first time in June. In the month, sales were up 00% on June 2019 as sales surged 00% YoY.

Sales for seasonal apparel such as dresses, T-shirts and shorts were boosted by warm weather at the start of the month, but tailed off as bleaker weather set in towards the end of the month.

Certain parts of the market have fared better than others of late. Firstly, Covid restrictions have favoured online players as consumers spend more time at home. Secondly, changes to working patterns prompted a shift away from formalwear towards casualwear. Thirdly, involuntary savings from fewer travel and leisure expenses saw consumers in secure jobs splurge on luxury items.

Unsurprisingly, the greatest change in consumer behaviour has been the shift away from physical stores towards online as a result consequence of multiple lockdowns.

Online Clothing & Footwear sales stepped up by 00% in June compared to two years earlier.

The vaccine roll-out should allow social restrictions to be eased and reduce consumer fears of contracting Covid-19, enabling pent-up demand for clothing to be released. That said, the seasonal nature of clothing demand means consumers are unable to delay purchases indefinitely, making it difficult for retailers to recoup lost sales.

Retail Economics forecasts Clothing sales to rebound over 2021, growing by 00% YoY to reach £00bn. However, we do not expect the market to fully recover to 2019’s pre-pandemic sales levels until 2025.

Asos reported total group sales rose by 27% YoY to £1.0bn in the four months to 30 June. Trading in the final three weeks of the period was reportedly more muted, as Covid uncertainty and adverse weather, particularly in the UK, impacted sales.

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Subscribe to access this data or take out a free 30 day subscription trial now.

Take out a free 30 day trial subscription to read the full report >

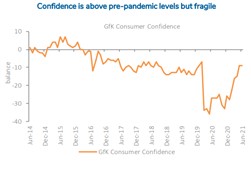

Confidence is above pre-pandemic levels but fragile

Source: GfK

Source: GfK