UK Clothing & Footwear Sector Report summary

February 2022

Period covered: Period covered: 02 January – 29 January 2022

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Clothing & Footwear Sales

Clothing (008%) and Footwear (00%) recovered strongly in January against last year’s lockdown according to Retail Economics. Compared to January 2020, Clothing sales were up 00% while Footwear was up 00%.

Sales were supported by the government’s more relaxed stance to the threat of Covid’s Omicron variant. This included a cut to the self-isolation, ahead of an end to work-from-home guidance.

Disruption impacting prices

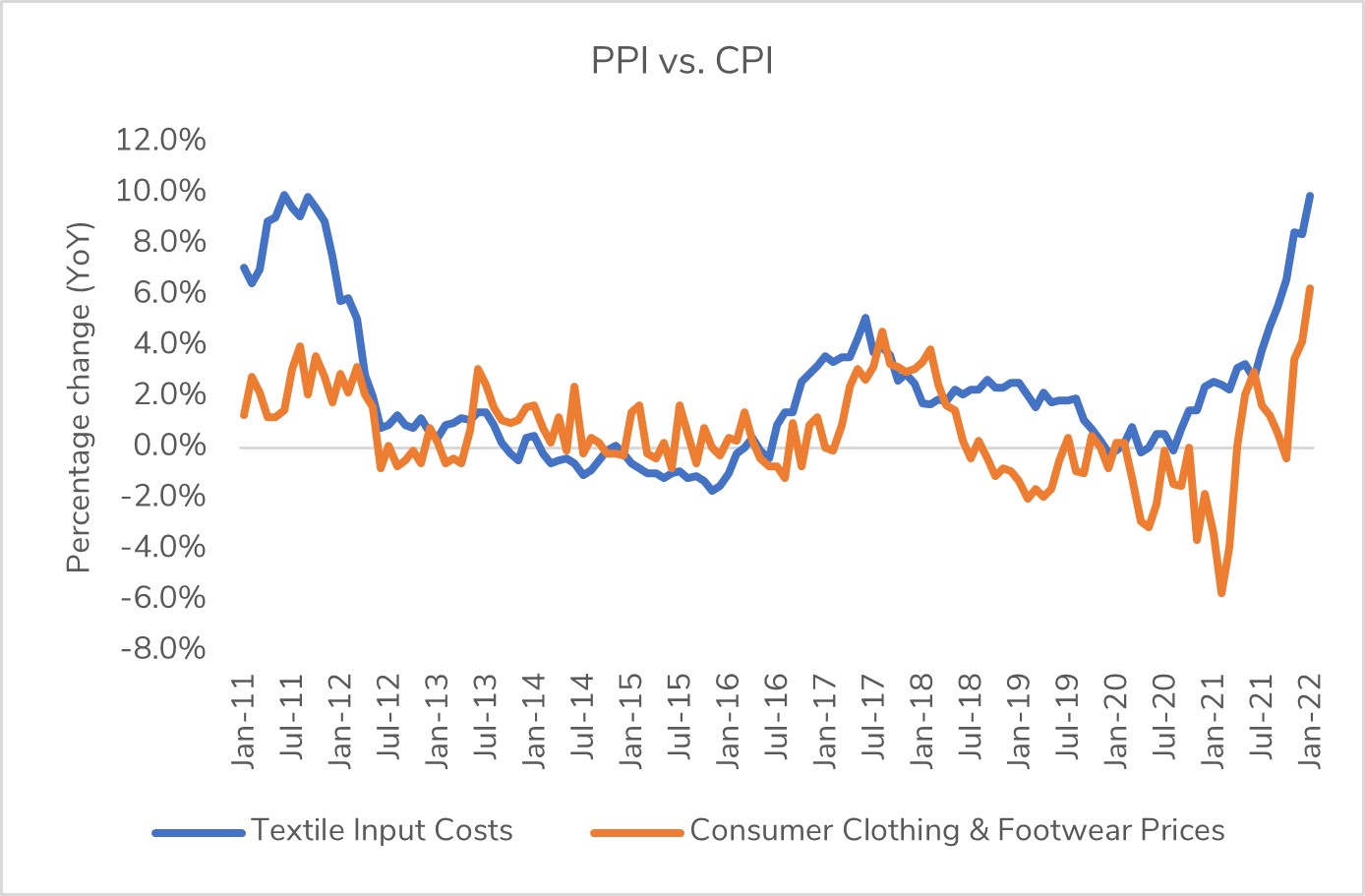

A recovery in demand has mounted pressure on supply, as firms face shortages, delays and cost base inflation.

This is impacting certain parts of the market more than others, such as fast fashion retailers reliant on rapid lead times with low margins. Ongoing manufacturing delays and rising logistics costs undermine such business models.

Retailers are trying to drive full price sales. Bellwether giants such as Marks & Spencer reported an impressive 45% increase in full-price clothing and home sales over the key Christmas period.

Attempts to shore up profitability are hitting consumer prices. Clothing & Footwear prices are rising at a record rate. Department store Next forecasts that prices for its spring and summer clothing ranges will rise by 3.7% YoY, while its autumn and winter ranges are set to see 6% inflation.

Spending is set to face headwinds from persistent inflation, as well as tightening across fiscal and monetary policy, including April’s National Insurance Contribution rise and rising interest rate expectations. This will hit the least affluent households the hardest, who spend the greatest share of income on essentials.

But on an aggregate, consumer spending is set to be cushioned by the £00 of additional savings consumers amassed during the pandemic from less commuting, fewer holidays and restricted socialising.

2022 Forecasts

As consumers learn to live with Covid, Clothing & Footwear demand should return with more consistency over 2022, and more aligned with pre-pandemic levels, helped by the return of social occasions (e.g. holidays, weddings, nightlife).

Retail Economics forecasts Clothing sales to grow by 00% YoY in 2022, reaching £00, and Footwear sales to rise by 00% YoY in 2022, reaching close to £00.

Take out a FREE 30 day membership trial to read the full report.

Input costs impacting consumer prices

Source: ONS, Retail Economics analysis

Source: ONS, Retail Economics analysis