Retail Economics Response - ONS Consumer Price Index September 2016

The Consumer Prices Index (CPI) rose by 1.0 per cent in September, the fastest in two years and ahead of expectations of a 0.9 per cent rise.The main upward contributors to the change in the rate were rising prices for clothing, overnight hotel stays and motor fuels, and prices for gas, which were unchanged, having fallen a year ago. These upward pressures were partially offset by a fall in air fares and food prices.Between August and September 2016, the main upward contributions to change in the CPI 12-month rate came from the following groups.Clothing and footwear: the upward effect came primarily from garments (in particular women’s outerwear), for which prices rose by 6.0 per cent between August and September 2016, compared with a rise of 3.3 per cent a year ago. Whilst this rise is relatively large historically, a rise in clothing prices in September is in line with normal trends and the comparatively large increase this year follows a sustained fall in prices between March and July. Although the impact of weaker sterling is likely to feed through in the coming months, most multiple retailers will be hedged until the end of the year.Restaurants and hotels: prices, overall, rose by 0.7 per cent between August and September 2016, compared with a smaller rise of 0.2 per cent a year ago. The upward contribution to the change in the 12-month rate was due to a rise in the price of an overnight hotel stay, compared with a fall a year ago. It is important to note that this follows an unusually large fall in August 2016.Miscellaneous goods and services: prices, overall, rose by 0.5 per cent between August and September 2016, having been unchanged between the same two months a year ago. The upward effect arose from smaller upward contributions across a range of items, most notably certain appliances and products for personal care.Housing, water, electricity, gas and other fuels: overall, prices rose by 0.1 per cent between August and September 2016, having fallen by 0.2 per cent a year ago. The upward effect on the change in the 12-month rate came from prices for gas, which were unchanged between August and September 2016, having fallen by 2.1 per cent between the same two months last year.Transport: overall, transport made a small upward contribution to the change in the rate, although this masks larger effects within the group. Rising prices for motor fuels had a large upward effect, with petrol prices increasing by 1.2 pence between August and September 2016. In 2015, fuel prices fell throughout the second half of the year. This upward effect was largely offset by prices for air fares, which fell by 24.2 per cent between August and September 2016, compared with a smaller fall of 20.4 per cent a year ago.The main downward contribution to the change in the CPI 12-month rate between August and September 2016 came from.Food and non-alcoholic beverages: overall, this group made a small downward contribution to the change in the rate. A more pronounced effect was seen for food, with prices falling by 0.3 per cent between August and September 2016, compared with a rise of 0.1 per cent a year ago. This was due to a combination of smaller downward effects across a range of food items. The downward contribution from food was mostly offset by rising prices for non-alcoholic beverages, having fallen between the same two months a year ago.

Chart 1 - Consumer Price Index

Source: ONS The Producer Price Index, indicative of costs faced by retailers from manufactures, rose 1.2 per cent in the year to September 2016, compared with a rise of 0.9 per cent last month. This is the third increase in a row following two years of falls.

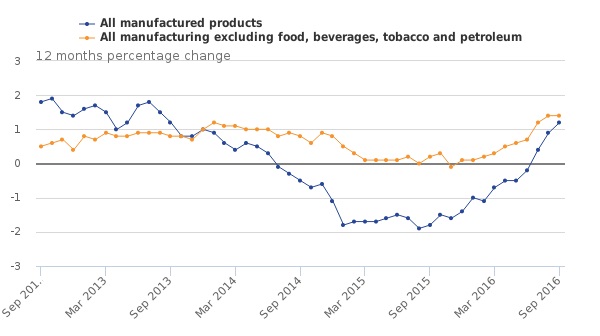

Chart 2. Producer Price Index – Output prices, percentage change year-on-year

Source: ONSThe impact of rising import costs is feeding through the supply chain and putting upward pressure on the cost of goods sold for UK retailers. This is the first real sense of a Brexit impact for many households. We expect inflation could hit 3 per cent next year. Combined with a weakening jobs market, as the reality of a weaker economy unfolds, households are going to feel the financial pinch.With retailers also facing spiralling costs through another round of National Living Wage increases, a rise in business rates and further pressure on imports, many will be forced to pass these on to customers as profit margins come under intense pressure.

Back to Retail Economic News